B2B CFO® offers Interim CFO® Services.

While not a comprehensive list, our Interim CFO® Services focus on the following business categories:

| Category | Relationship to Interim CFO® Services |

|---|---|

| Financial Statements | The key financial statements for a company are the Balance Sheet, Income Statement and Cash Flow Statement. One of our services is to help an owner to understand the key factors in each of these statements in order to help the owner to have information needed to make important decisions |

| GAAP or Cash | Most businesses are required to operate on the Accrual Basis of Accounting, which are to be standardized under a term called GAAP (General Accepted Accounting Principles) in order to meet compliance issues with bankers, accounting firms, governmental agencies, etc. GAAP specifications include definitions of concepts and principles, as well as industry-specific rules. Some companies run on the Cash Basis of Accounting, however, there are IRS (Internal Revenue Service) rules that require companies with a certain sales volume to convert to the Accrual Basis of Accounting. Our services are to help an owner to know which accounting basis to use and to bring expertise into a company with these complicated matters |

| Management Reports | Management reporting systems take information needed by a company in order to run the company according to the goals of the owners. One of our services is to help the owner identify the types of management reports needed and to work with management on the development and accuracy of such reports |

| Accuracy | It is difficult for most internal accounting departments to create accurate financial and managerial information. One of our services is to help with this important matter. The goal is to identify areas that are not accurate and to create internal controls to help with this important matter. We realize that owners make important decisions and accurate financial information is paramount in order to assist owners with their decision-making process |

| Timeliness | An owner should have key financial and managerial reports between the 5th to the 15th day after month-end. One of our services is to train internal staff and to help with the internal controls of a company to help the company create timely financial and managerial information |

| Interpretation | Financial and managerial reports can be complicated. One of our services is to assist owners identify key data in these reports for future goal attainment and decision making |

| Profit Improvement | The company's KPI's (Key Performance Indicators) give a clue about industry norms related to profit, whether to a C-corporation or pass-through entities (S-corporations, LLCs, LLPs, Sole Proprietorships, etc.). Our services includes the ability to educate an owner on the ideal profit a company should make as well as to identify barriers that are in the way of a company making that ideal profit |

| Expense Reduction | Expenses can grow dramatically in a company. These expenses can often harm the profit owners desire the company to earn. Our services are to identify the KPI's of expenditures and to assist owners with consultation of keeping expenses within industry norms |

| Software | Not all software is equal in creating timely and accurate financial and managerial information. Our service is to consult with owners on their existing software to assist the company with its existing software. We occasionally may need to give management advice on other software applications that may be in the company's best interest in creating timely and accurate information |

| Other | Each partner in our firm averages about 25 years of experience after graduation from a major college or university. We bring to a company the experience we learn regarding Interim CFO® Services. We also bring a combined experience of approximately 7,000 years of experience to each client that hires a partner in our firm |

The key focus of our Interim CFO Services® is usually related to the infrastructural needs of a privately held company.

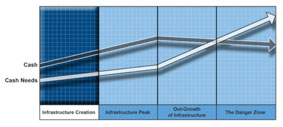

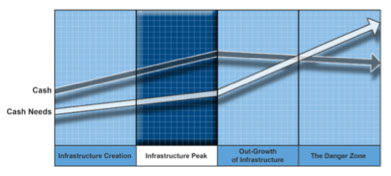

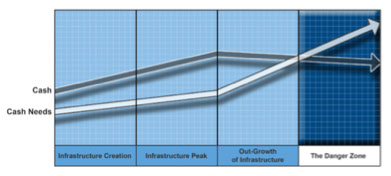

One of the tools utilized while providing Interim CFO Services® is our book, The Danger Zone, Lost in the Growth Transition, which addresses the infrastructure processes of a company, namely:

- Creation

- Peak

- Outgrowth

- The Danger Zone

Infrastructure Creation

Cash in the Infrastructure Creation cycle is usually greater than the cash needs of a company. The business owner has good relationships with customers. The company is not very complicated at this stage and much of the cash needs of the company can be met by owners being able to keep important information in their minds. Decisions can be made easily and without a lot of financial or managerial information. Owners usually spend a lot of one-on-one time with customers. Owners have the time to cultivate good relationships with people inside and outside of the organization.

Infrastructure Peak

This is somewhat of a "honeymoon" time for the company and the future looks very bright.

This cycle allows owners the time to focus on the future vision of the company. This cycle is typified by the following:

- High customer service

- Short cash collection cycles

- Few customer complaints

- Low overhead

- Personal financial sacrifice by owners

Companies in this cycle run "mean and lean" and are relatively easy to manage. The cash balance in the bank begins to increase and owners begin to feel a false sense of security.

The large cash balance that is in the bank will soon disappear.

Out-Growth of Infrastructure

The company has now grown in sales, employees, customers, vendors, etc. It begins to display certain symptoms that did not exist in the past, such as:

- Customer complaints increase dramatically

- Customers begin disputing charges on invoices

- Certain customers refuse to accept goods or services

- Orders of goods or services from customers unexpectedly decrease

- More time is spent fixing the problems of smaller customers than with customers that bring higher profits to the company

- The company's quality of its goods or services decrease

- The accounting department begins giving the owner inaccurate information

- Owners begin to spend too much of their time in unproductive meetings

- Financial and managerial information is delayed, causing the owner to make important decisions without the required information

- Etc.

This cycle often causes decreases in the company's cash. There are now periodic shortages of cash that did not exist in the past. Owners often see their company's cash "die the death of a thousand cuts" in areas such as:

- Employee overtime increases

- Employee theft of money, time and/or inventory is suspected

- Employee benefits, such as health care, 401(k) and other categories begin to increase

- Non-sellable inventory begins to stockpile

- Computer software and hardware expenses increase

- Overhead expense unexpectedly increase

- Legal and professional fees increase

This cycle ultimately causes the cash needs of the company to equal the cash inflow of the company. The company is now in danger of not being able to meet payroll, pay its vendors on time, pay rent and to manage other complexities of the company related to cash flow.

The Danger Zone

We define The Danger Zone cycle as the period of time when the cash needs far exceed the available cash of the company. This is a most stressful time for business owners. In fact, the future viability of the company is now in question.

Our goal is to work with business owners to keep them out of The Danger Zone. We have the proven talent, tools and processes to assist business owners with their needs.

Our firm was established in 1987. Each partner in our firm averages about 25 years of experience. Collectively, we have about 7,000 combined years of CFO experience.

A company may receive a complimentary Discovery Analysis™ by submitting a request at www.b2bcfo.com/discovery-analysis.html.

We would enjoy meeting you and will give you a complimentary industry benchmark report. You can see a sample of the report at www.b2bcfo.com/industry-comparative-report.html. It is highly likely you will know more about your company than you know today after receiving our complimentary Discovery Analysis™.

All three of our books can be purchased on the Store button of our website, www.b2bcfo.com.

First Direction, Then Velocity® was awarded to our firm by the United States Patent and Trademark office on July 17, 2012 (Reg. No.4,216,280).