Banking & Lending

Debt Refinancing

Definition: In debt refinancing, a borrower applies for a new loan or debt instrument that has better terms than a previous contract and can be used to pay down the previous obligation. An example of a refinancing would be applying for a new, cheaper loan and using the proceeds from that loan to pay off the liabilities from an existing loan. (Investopedica.com)

Strategic thinking: This subject matter takes strategic thinking to possibly help a company get out of a current financial bind.

Reasons: There are various reasons for refinancing, with the most common reasons being reducing interest rates on loans, consolidating debts, changing loan structure and freeing up cash. (Investopedia.com)

Lines of credit: A line of credit (LOC) is used as working capital to draw upon to pay off current obligations of a company, such as payroll, rent, vendors, etc. The LOC is a short-term borrowing instrument that is usually guaranteed by trade receivables, inventory and a personal guarantee of the owner.

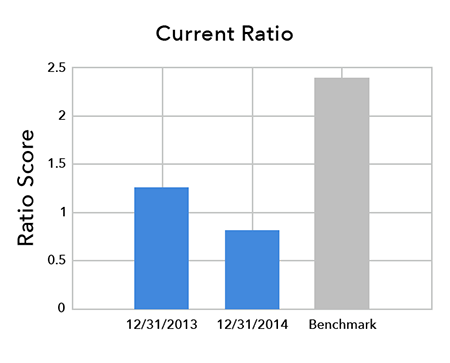

Current debt refinancing: Banks use key ratios to decide on whether to renew LOCs, which are usually renewed annually. The most often-used ratio is called the Current Ratio, which measures a company's liquidity and its ability to pay its current obligations within the next 12 months.

A Bad example: The following graph is from a real company that shows a negative Current Ratio. This example would be an extreme red flag to a bank that is considering renewing a LOC. The latest Ratio Score is below 1.0, which tells a bank that the company can't meet its current obligations. Even worse, the bank will compare this company's low Current Ratio to the Benchmark, which are companies in the same industry and with a similar sales volume. The likelihood of a renewal of a LOC of a company in this condition is remote. In this situation, the bank may demand the amount owed on the LOC to be repaid immediately.

A Solution: A possible solution to solve the above scenario is to "refinance" some of the current LOC and/or some other current obligations. The goal would be to take some current debt and refinance it into long-term debt in order to create a good Current Ratio. The new Current Ratio should not only satisfy the bank but should give the company enough liquidity to comfortably pay its bills on time, which should allow the owner of the company to focus on other important matters.

The Process: The owner, management and the company's professionals would look at the current debt to see what amounts could be put into long-term debt. Let's imagine that a company owes $2M on its LOC and that taking $800,000 from the LOC into long-term debt would solve the immediate Current Ratio problem. The team would prepare a loan package request for the bank to move $800,000 into a long-term note payable. The new note would require different collateral. The loan package would need to have explanations about how the company got into its present predicament and how the bank would be adequately collateralized with the new note payable for the $800,000.

Financial Statements: It is imperative that the company's interim financial statements be timely and accurate.

Forecasted Statements: The loan package should contain forecasted financial statements, showing the "before" and "after" effects of the debt refinancing. The forecasted financial statements should show the current portion of the new long-term debt, along with satisfactory explanations about how the company would pay the new note payable, along with the interest expense associated with the new note.

SBA: Most of these banks have become specialists in obtaining SBA guaranteed loans. It is not unusual for a bank to split a loan into two parts, one that is guaranteed by the SBA (with longer repayment periods) and a second one issued by the bank, with shorter payment periods. The SBA guaranteed loan might be a good solution for the debt refinancing in such a scenario.