B2B CFO® will benchmark your company against others in the same industry and then using this information, show you how to grow your company and Exit SuccessfullyT. Get your free Discovery Analysis today (a $1600 value)!

EXIT SUCCESSFULLY™

We serve privately-held companies with sales up to $350 Million

Copyright © 2013 by B2B CFO®

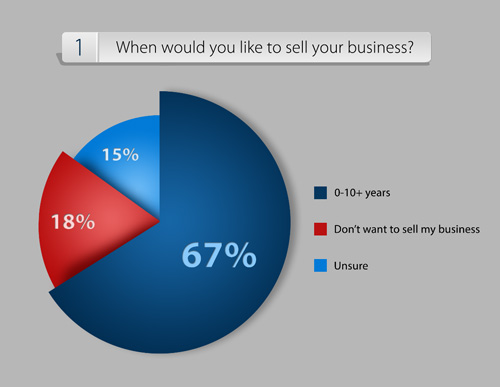

A business survey was conducted by B2B Exit®, a division of B2B CFO®, at the 2013 Inc. 500|5000 Conference and Awards Ceremony in Washington D.C. held from Oct. 10-12, 2013. The surveyed business owners confidentially answered the following questions:

The following graph shows the responses of the 271 surveyed business owners:

These 271 business owners consisted of the following types:

Inc. 500 honorees 21%

Inc. 5000 honorees 64%

Other owners 15%

Of these owners, 37% want to sell their business within 0 to 5 years; 20% want to sell between 6 and 10 years, and 10% desire the event to happen more than 10 years in the future. Of the respondents, 15% were unsure of when they want to sell their business, and about 18% do not want to sell their business.

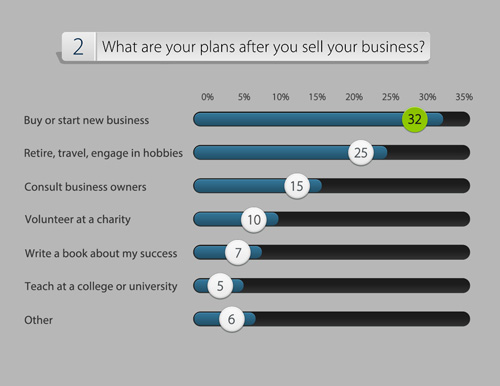

Business owners responded as follows regarding their plans after the sale of their business:

This survey indicates that 32% of the respondents are “serial business owners” who want to buy or start a new business after they sell their current business.

Only 25% of the owners want to retire, travel or engage in hobbies.

Approximately 27% of these owners want to pass on their experiences to others by consulting for business owners, writing a book about their success, and teaching at a college or university.

Nearly 10% of them want to volunteer at a charity after the sale of their business.

More than 4% responded “other” regarding their plans following the sale of their business. It is not surprising that the answers varied. Some business owners said it is too early to sell their business, while others said they would stay on in their business. There were those who said that after a sale they would start a foundation or run a non-profit organization. Then there were those business owners who said they were “not sure.” The more adventurous of the business owners said they wanted to fly an airplane or simply fly. There were also business owners who said they would like to combine the following: help other businesses grow, take time for themselves, and give back to the community. Some even said they would choose all with the exception of charity work.

Business owners responded as follows regarding their concerns about selling their business:

Interestingly, almost half of business owners were concerned about the value of their company. Of these owners, 31% were not sure if the value of their company was high enough. Those with the highest concern about the value of their company were the Inc. 5000 winners, comprising almost 36% of total respondents..

Some of the most surprising responses to this survey were the almost 18% of business owners who did not know the value of their company. Of these owners, 80% were Inc. 500|5000 honorees. These owners represent some of the fastest-growing companies in America. They know the sales growth of their companies but not the correlation of the growth to the value of their companies.

Almost 11% had issues with management and conflicts with other business owners. There were 7% who admitted that they lacked a management team sufficient to sell their business. Almost 4% of the owners said they have conflicts with other owners within their business.

Almost 13% of these high achievers were uncertain about cash issues related to the sale, with almost 7% not knowing the amount of net cash needed from the transaction, and 6% did not know what price to charge for the sale of their company. Both of these issues may relate to lack of information regarding the correct market value of their company, which was a concern of almost 50% of the owners who took this survey.

About 10% of the owners had issues with time and assistance with regard to the sale of their company. Almost 6% said they do not have time to start the process to sell their business, and about 4% said they need help to start the sales process.

While there are business owners who think about selling their business, they often have concerns about a sale. There are various reasons for not wanting to sell. When asked about their No. 1 concern about selling their business, almost 18% of owners' answers included being too young to sell, best timing, cannot decide on selling, the economy, and future work for family members.

One owner said his business may have garnered the attraction of one of the major ice cream brands to the point of a possible acquisition. Another owner said he would give the business to his family. Another owner expressed that growth opportunity is huge over the next five years.

Other answers included an owner who said, “I'm not replaceable enough,” while some relayed that their business is a start-up. Another owner said, “It is so far out I would need someone else to plan.” One said his businesses were just acquired, and another said, “Most M&A guys front private equity big guys who [do not care] about the owner really making money when they sell.” Still another said, “Net proceeds after all selling cost.” Included among the answers were some who said “none.”

Additional answers from business owners included the following: not being in control, not ready, not ready yet, not really any concerns, not sure the company is marketable, not sure what to do next, pricing, selling too soon, starting, still having too much fun. One owner answered, “Taking care of the employees who believed in me and trusted me to do good by them.” Still there were some owners who wrote timing, timing effect on leadership, timing.maturation, too many moving parts to the business model. Another answered, “Want to continue having fun and independence,” while another said, “What to do after.” Still another owner answered, “Wouldn't know what to do with myself.”

| Total | Inc. 500 | Inc. 5000 | Other Owners | |||||

| When would you like to sell your business? | ||||||||

| 0-5 years | 100 | 37% | 22 | 40% | 70 | 36% | 8 | 20% |

| 10+ years | 26 | 10% | 4 | 7% | 15 | 7% | 7 | 17% |

| 6-10 years | 53 | 20% | 10 | 18% | 36 | 19% | 7 | 17% |

| I don't want to sell my business | 50 | 18% | 8 | 15% | 32 | 23% | 10 | 24% |

| Unsure | 42 | 15% | 12 | 20% | 21 | 15% | 9 | 22% |

| Grand Total | 271 | 100% | 56 | 100% | 174 | 100% | 41 | 100% |

| Total | Inc. 500 | Inc. 5000 | Other Owners | |||||

| What are your plans after you sell your business? | ||||||||

| Buy or start a new business | 84 | 32% | 18 | 32% | 51 | 29% | 15 | 52% |

| Retire, travel, engage in hobbies | 65 | 25% | 15 | 27% | 44 | 25% | 6 | 21% |

| Consult business owners | 40 | 15% | 9 | 16% | 28 | 16% | 3 | 10% |

| Volunteer at a charity | 25 | 10% | 5 | 9% | 18 | 10% | 2 | 7% |

| Write a book about my success | 19 | 7% | 4 | 7% | 13 | 7% | 2 | 7% |

| Teach at a college/university | 12 | 5% | 3 | 5% | 9 | 5% | 0 | 0% |

| Other | 11 | 4% | 0 | 0% | 10 | 6% | 1 | 3% |

| Help family members | 7 | 2% | 2 | 4% | 5 | 2% | 0 | 0% |

| Blank | 0 | 0% | 0 | 0% | 0 | 0% | 0 | 0% |

| Grand Total** | 263 | 100% | 56 | 100% | 178 | 100% | 29 | 100% |

| Total | Inc. 500 | Inc. 5000 | Other Owners | |||||

| What are your concerns about selling your business? | ||||||||

| Value not high enough | 71 | 31% | 11 | 24% | 54 | 36% | 6 | 21% |

| Don't know company's value | 40 | 18% | 6 | 13% | 26 | 17% | 8 | 28% |

| Other | 40 | 18% | 8 | 17% | 24 | 16% | 8 | 28% |

| Lack of a management team | 16 | 7% | 4 | 9% | 11 | 7% | 1 | 3% |

| Can't decide amount of net cash needed | 15 | 7% | 6 | 13% | 8 | 5% | 1 | 3% |

| Can't decide the sales price | 14 | 6% | 5 | 11% | 7 | 5% | 2 | 7% |

| No time to start the process | 13 | 6% | 3 | 7% | 8 | 5% | 2 | 7% |

| Conflicts with other owners | 9 | 4% | 1 | 2% | 8 | 5% | 0 | 0% |

| Need help starting process | 9 | 3% | 2 | 4% | 6 | 4% | 1 | 3% |

| Grand Total** | 227 | 100% | 46 | 100% | 152 | 100% | 29 | 100% |

* Note: These numbers do not total 271 because some said they did not want to sell their business and others gave several answers to the question.

View Demo

WE SIMPLIFY THE PROCESS

Chapter 1: Who Needs This Book?

Excerpt from The Exit Strategy Handbook: The BEST Guide for Selling Your Business

Copyright © 2013 by Jerry L. Mills and B2B CFO, LLC.

The premise of this book is simple. It is a tool to help business owners sell their business.

There is no fluff or hyperbole in this book. It is results oriented with the goal of assisting business owners in solving a very complicated problem. The Exit Strategy Handbook is a process to help owners who:

Attributes and Characteristics

Let's first be objective about your future exit from your current business. The following is from one of our books, Avoiding The Danger Zone, Business Illusions.

Benjamin Franklin is credited with the adage, “In this world nothing is certain but death and taxes.” That statement is as true today as it was when he wrote it more than 200 years ago. We can add another truism for today's business owners: You will exit your company one day in the future.

Your exit from your company may be planned or unplanned. The exit may bring satisfaction or dissatisfaction to you and your family. It may be to the benefit or detriment of your employees or associates. It may bring great financial reward, or it may bring financial devastation.

The exit may bring fame or shame to your family and friends. It may be the continuance or discontinuance of the company you have worked so hard to build and create. The exit may be to the benefit or detriment of your competitors. Regardless of the consequences, you will someday exit your company in one form or another.

The beginning of the process to sell a business requires a certain mind-set. It requires a short-term focus. The beginning of the focus process is to accept that certain things are currently outside of your control, such as:

It is natural to be concerned about such matters. Upon close examination, these are all long-term issues that are currently beyond your control.

The process of selling your business is a short-term project. You will have time and, hopefully, a lot of money to revert back to being concerned about these subjects after the successful sale of your business.

The items above are a distraction and could impair your ability to focus on the goal of completing the sale of your business.

In the short-term, there are certain things that are under your control that require focus and attention, such as:

The following, written by American theologian, Reinhold Niebuhr, might help us keep focused on the short-term things that are under our control.

God, give me grace to accept with serenity the things that cannot be changed,

Courage to change the things which should be changed,

and the Wisdom to distinguishthe one from the other.

We can look into your future and visualize the following exit options. One of these will occur to you:

We leave the first three of the above topics to other authors and professionals.

This book and its processes focus solely on the latter: Sell the business.

Naturally, one of the concerns that business owners have is who will eventually buy their business.

Business owners often have a lot of options related to this topic of selling a business. It is a myth that the sole option is to sell only to third parties.

There are multiple possible buyers for a closely-held business. Some of the most common possible buyers are:

It is common for a business owner to become distracted about the potential buyer and what that buyer might do to the business long before there is even a discussion with the prospective buyer. Some of the most common concerns of business owners are:

Our advice is not to be preoccupied with these issues at this time. There will be sufficient time to work on these details during our process. These burdens should be shifted off your shoulders and onto the shoulders of other people. We call these people The Success Team™.

One of the most important processes in this book is to surround yourself with The Success Team™, which is discussed in Chapter Three. It will be the job of the members of this team to help you find the right buyer for your business.

You will have adequate time and a proper format to tell the members of The Success Team™ about your concerns. You will also be able to delegate to them the responsibility to help you with these important concerns. This team will help you with the exit plan.

The exit plan will be created over a period of time using our process. An extremely successful entrepreneur said the following about not having an exit plan.

In the absence of a valid exit strategy, events will inexorably dictate the final exit plan for the business.

Exit plans may be as varied as each venture's needs and purposes. In the absence of an Exit Plan, it is probable that an involuntary exit will be enforced by any number of circumstances: loss of market, competition, a better mouse trap, changes in customer acceptance, inept management, catering to wants instead of needs, lack of cost controls, etc.

Gardner H. Russell

The late Stephen R. Covey was brilliant in this very simple concept of beginning with the end in mind. Regarding this subject, he stated:

To begin with the end in mind means to start with a clear understanding of your destination. It means to know where you're going so that you better understand where you are now and so that the steps you take are always in the right direction.

Dr. Covey not only emphasized going in the right direction, he also taught that it takes leadership to make sure one is going in the right direction. He taught the following about the difference between leadership and management:

It is time to make the first important decision in this process.

The principles of this decision combine the teachings of Dr. Covey and Reinhold Niebuhr. This step is you taking the leadership to head in the right direction with the attitude of having courage to change those things that are within your power. The recommended decision is:

To increase the value of your business with the goal of having multiple bids to purchase your business.

In the short term, put behind the concern of who might someday buy your business. It is now time to begin the process to build so much value that, hopefully, you will have multiple buyers who might want to purchase your business.

We have created an additional tool to help with your exit strategy success. We have dashboard software to help your team manage this process. You will be able to access the dashboard by a secured password. The dashboard software contains important information, such as:

The process to obtain your subscription to this online dashboard software is explained later in this book. The teachings of this book and the dashboard software will validate why this book is subtitled: The BEST Guide for Selling Your Business.

This book will discuss that you will have competition from other sellers. They have no interest in your success. Their goal is to take away your buyer. You will have a significant competitive advantage over these competitors if you can eliminate certain distractions that will present themselves to you in the near future. The following about distractions is from one of our books:

Gordon Segal is the founder and CEO of Crate and Barrel, which he and his wife founded in 1962. The Retail Marketing Association voted Mr. Segal Retailer of the Year in 1996. Mr. Segal made one of the most profound business statements, which was documented in INC. Magazine:

Getting distracted is the biggest problem entrepreneurs' face.

The authors of The Millionaire Next Door said the same thing in different words:

Efficiency is one of the most important components of wealth accumulation. Simply: People who become wealthy allocate their time, energy and money in ways consistent with enhancing their net worth.

The process begins with the next chapter, exploring whether the future will be a buyer's or a seller's market for your company.

We have the process to find the buyer or seller, which may be one of the

following:

Strategic

Financial

Private Equity Group (PEG)

Family members

ESOP

Management buyout (MBO)

Family buyout

Etc.

Our software and B2B CFO® Team Manager tracks the buy or sales process.

We help build and manage The Success Team™.

We help prepare the buyer or seller.

Our professionals are experienced and trained for this process.

B2B CFO® will benchmark your company against others in the same industry and then using this information, show you how to grow your company and Exit SuccessfullyT. Get your free Discovery Analysis today (a $1600 value)!

LEARN THE REALISTIC VALUE OF YOUR COMPANY

Chapter 4: The Realistic Value of Your Business

Excerpt from The Exit Strategy Handbook: The BEST Guide for Selling Your Business

Copyright © 2013 by Jerry L. Mills and B2B CFO, LLC.

You can increase the value of your business if you understand how buyers are likely to value it.

Frederick D. Lipman 27

Any profitable business can be sold. It's just a matter of value, terms and structure. Total company value is not always equal to the cash received at the close of the sale of the business.

Larry Reinharz, Managing Director, Woodbridge International

This chapter will give you and The Success Team™ the tools to arrive at a realistic value of your business. These tools will also be able to be used to determine if the value of your business materially increases or decreases during the exit strategy process.

The subject of the realistic value of your business can be one of the most difficult topics during the exit strategy process. Business owners often feel:

The process of placing a consistent dollar value on your business can be very frustrating. One of the frustrations is the numerous ways that buyers and appraisers use to value a business. Additional irritation arises because some appraisers use two or more valuation methods within the same report. Below are some of the most common valuation methods:

The following is an example of how difficult this subject is and how different valuation methods can create significantly different results. In this fictitious example, the company name is PrivateCo, which is owned by Joe Mainstreet. The same financial information (Balance Sheet and Income Statement) was used to determine all of the following values.

This author said the following about this table:

If PrivateCo's owner Joe Mainstreet is advised that his company is worth a specific dollar value and that all of his decisions should revolve around that value, Joe and PrivateCo could suffer as a result of that advice. - Robert T. Slee

Let's imagine that Joe Mainstreet is advised to use the Public Value of $18.2M in his exit strategy planning. There are multiple decisions that Joe Mainstreet could make using this value, such as:

Let's now imagine that the top buyer approaches Joe Mainstreet and offers the Fair Market Value ($6.8M), which is $11.4M less than he was expecting. It is highly likely that all of the decisions he made based on the $18.2M Public Value are wrong. Hence, Mr. Slee's statement is absolutely correct, “Joe and PrivateCo could suffer as a result of that advice.”

Your company's balance sheet has assets, tangible and intangible, that may have value to the future buyer. Those assets will be valued using certain methods sometime before the purchase. The process in this chapter will not calculate the value of those assets. Rather, their value will be deferred to the future until your company is closer to bringing in a potential buyer.

The buyer will determine which of your company's assets it wants to purchase. Be prepared for the buyer to not be interested in purchasing some of your company's assets, such as your building.

It has been our experience that almost all companies have material errors on their balance sheets. These errors are often compounded if the company owns subsidiary companies. These errors may have a significant impact on the valuation process to be explained below. It is critical to fix any potential errors on the balance sheet prior to going through the valuation process explained in this chapter.

A number of businesses are valued by buyers based upon accounting earnings or income. Indeed, one of the most common methods of valuation is the so-called EBITDA method. This involves the determination of your accounting earnings before interest, taxes, depreciation, and amortization (EBITDA), and multiplication of the EBITDA by the relevant multiplier to obtain a business valuation. Frederick D. Lipman 30

The main indicator of value, to a PEG (Private Equity Group), or other buyer, is earnings before interest, taxes, depreciation and amortization, or EBITDA. EBITDA is a framework that allows buyers to compare “apples to apples” instead of “apples to oranges” when viewing businesses with different operating structures. Robert W. Scarlata 31

For each $1 that you increase your EBITDA during the valuation year, you should arguably receive an additional $4 to $6 in sale price.32

This chapter will illustrate several steps to the valuation of your company using the EBITDA method along with an explanation of these steps:

The calculations below assume two types of companies: taxable and pass-through. A taxable entity is a C-Corporation. Pass-through entities are typically S-Corporations, limited liability companies (LLC), partnerships or sole proprietorships.

| DESCRIPTION | TAXABLE ENTITY | PASS-THROUGH ENTITY |

|---|---|---|

| Revenue | $9,000,000 | $9,000,000 |

| Cost of sales | 6,000,000 | 6,000,000 |

| Gross profit | 3,000,000 | 3,000,000 |

| Administrative expense | 1,900,000 | 1,900,000 |

| Income before taxes | 1,100,000 | 1,100,000 |

| Income taxes | 440,000 | -- |

| Income after taxes | $660,000 | $1,100,000 |

| EBITDA calculation | ||

| Income after taxes, above | $660,000 | $1,100,000 |

| Interest expense | 180,000 | 180,000 |

| Income taxes | 440,000 | -- |

| Depreciation expense | 105,000 | 105,000 |

| Amortization expenses | 15,000 | 15,000 |

| EBITDA | $1,400,000 | $1,400,000 |

The difficult part of using EBITDA as a valuation method is the identification of adjustments to EBITDA, which are usually items that might be considered distortions to the EBITDA calculation by prospective buyers. The Success Team™ needs to spend time identifying and discussing any possible adjustment to EBITDA long before an examination is performed by independent CPAs and before any discussion with prospective buyers.

Your EBITDA is then adjusted to remove expenses and revenue that will no longer be carried forward into the new business. These adjustments can be quite substantial for a closely held family business.

Most closely held businesses are operated to minimize income taxes. As a result, excessive compensation and perquisites may be provided to the owner and his family in order to reduce taxes. The excessive compensation and perquisites are really forms of disguised dividends. Frederick D. Lipman 33

One of the most frequent errors in performing this kind of analysis is to take the EBITDA or EBIT numbers at face value, without considering whether these numbers really reflect the true economic performance of your company.

Your financial statements will seldom reflect the real economic performance of your company. Numerous distortions may creep in. Les Nemethy 34

It is important to understand that The Success Team™ and a prospective buyer are not judging your business acumen on the decisions you have made on certain expenses in the Income Statement. Rather, they are trying to evaluate what the EBITDA of the company might be under normal circumstances. The prospective buyers are also trying to compare your company to similar types of companies in order to determine which company, if any, they might want to purchase. It is very important to be open with the members of The Success Team™ and to not take personal offense about this discussion. The goal of The Success Team™ is to help you through a most difficult process.

Some business owners face the issues of income tax avoidance and income tax evasion during this process. This topic will be covered in a subsequent chapter of this book.

As a way to illustrate this subject of adjustments to EBITDA, let's look at a potential adjustment that would be a decrease to EBITDA.

The owner/manager of Company A draws no salary from the company. His market salary would be $200,000 per year, or $250,000 grossed up with all payroll and social security taxes. If an investor were to buy this business, the former owner/manager would presumably not be prepared to stay and work for free indefinitely; nor would a replacement be willing to work for free. Presumably the new managers would ask for a market salary. Hence EBITDA and EBIT (Earnings before interest and taxes) would be diminished by $250,000. 35

This example makes sense. You would do the same if you were considering purchasing a company. You would look at the Income Statement to see if the owner/manager had not been deducting a salary. Your first reaction would be something like, “It will cost me at least $250,000 to replace this guy, so I am going to lower my offer to this company because of my future costs that are not currently recorded in this company's expenses.”

Again, this is not a judgment of your business acumen. Rather, it is a prudent analysis by a prudent potential buyer about the future increase in operational costs of your business. This is merely a business decision that must be made by the prospective buyer. It is also a business analysis that should be considered by The Success Team™.

Below is an example of an adjustment that would be an increase to EBITDA.

The son of the owner/manager of Company B is 17 years old and is working part-time for Company B, drawing a salary of $100,000 (fully grossed up). The son is not producing anything of value for Company B, nor would the investor wish to continue with the son on the payroll. In this case, EBITDA and EBIT would be increased by $100,000. 36

Some owners can get a bit extravagant in their expenses to the company.

The owner of Company C purchased four helicopters. This was not at all necessary for operation of the company's core business (This has actually happened!). The $450,000 required for the operation of the helicopters should be added back to EBITDA and EBIT. 37

Some business owners can become very creative on the topic of writing off personal expense in the company's Income Statement:

I know a businessman in Texas who writes off almost $10,000 annually on his personal “work boots.” He really does purchase the boots, but they tend to come in exotic leathers like ostrich and boa constrictor, and he seldom wears them to work. 38

Below is a list of potential discretionary items in the Income Statement that may be adjustments to EBITDA. These adjustments may be either increases or decreases to EBITDA and may have a material impact on the valuation of the business:

Not all adjustments are discretionary items such as the above examples. Some adjustments are one-time or otherwise unusual expenses.

My company negotiated the sale of a business that was operating a large fleet of trucks. Suddenly, fuel prices shot up to unprecedented levels. We assessed the situation and found reason to believe that fuel prices would be more stable in the future. In preparing the profit and loss statement for EBITDA purposes, we recast the most recent fuel costs to more reasonable levels. Robert W. Scarlata 39

Below are examples of one-time, nonrecurring or unusual expenses that might be included in adjusted EBITDA:

In short, The Success Team™ should carefully comb through the Costs of Sales, Selling, General and Administrative and Other Expense categories to determine if there are one-time, nonrecurring or unusual expenses in the Income Statement. As a rule of thumb: When in doubt, disclose the item and place it in adjusted EBITDA.

Once adjusted, EBITDA needs to be multiplied by a certain range of numbers that are called “multipliers.” These numbers are used to help with the estimated valuation of your business.

The adjusted EBITDA is then multiplied by a multiplier to obtain an overall valuation for the business (also called “enterprise value”). The multiplier typically ranges from 4 to 6 times adjusted EBITDA, particularly for financial buyers. However, the multiplier has gone below 4 and substantially above 6, depending upon whether it is a buyer's market or a seller's market for the sale of businesses. A multiplier above 6 is more typical for strategic rather than financial buyers.

Multipliers of 20 or more are not unheard of for strategic buyers of companies with strong market niches.

The multipliers are derived from comparable company valuations, including the multipliers applicable to public companies in the same industry. For example, if a public company in your industry has a total market valuation (based on its stock price) of 10 times its EBITDA, this multiplier could be the starting point in determining the appropriate multiplier.

This multiplier would then be discounted by the fact that your company was smaller and has less market dominance.

Many business owners incorrectly assume that the multipliers applicable to larger companies in the industry apply to their smaller company. The multipliers for less dominant companies in an industry are significantly smaller than for dominant companies. 40

The multiplier used for your company will depend much upon whether you sell during a buyer's or seller's market, as is explained in Chapter Two of this book.

On the next page is one author's (Rick Rickertsen 41) view of the different levels of multipliers to be applied to adjusted EBITDA.

| Option | Multiple |

|---|---|

| Strategic Buyer | 8-10x |

| Private Equity (Financial Buyer) | 6-8x |

| Management Buyout (MBO) | 5-7x |

| ESOP | 5-6x |

This topic should be discussed by the members of The Success Team™ in order to find the estimated multipliers relevant to your business during the exit planning process.

The following is a fictitious illustration of ABC Example Company, Inc. The Success Team™ has worked together to find the adjustments to EBITDA and the appropriate estimated multiplier. They have already calculated EBITDA and will begin to add or subtract the adjustments. They will then use the agreed-upon estimated multiplier of five times adjusted EBITDA to arrive at the estimated value of the business.

Adjusted EBITDA and the Valuation Calculation

| DESCRIPTION | AMOUNT |

|---|---|

| EBITDA | $795,000 |

| Additions: | |

| Legal, reorganization, audit and appraisal costs to prepare for the sale | 165,000 |

| Salaries of family members that will not continue with the buyer | 125,000 |

| One-time bonuses paid for a nonrecurring and unusual transaction | 75,000 |

| Officer life and disability insurance that will not continue after the sale | 25,000 |

| Legal and other costs to buy out a minority owner of the company | 80,000 |

| Country club fees and season tickets to the Chicago Cubs | 25,000 |

| Vehicles, education and other expenses for three family members | 45,000 |

| Deductions: | |

| Increase in the cost of the person that will replace the owner/manager | (50,000) |

| Rent paid to the owner below market value for an equivalent building | (45,000) |

| Below-market salaries paid to key employees to continue with the buyer | (40,000) |

| Adjusted EBITDA | $1,200,000 |

| Multiplier | 5x |

| Estimated value of ABC Example Company, Inc. | $6,000,000 |

Remember, this is a preliminary valuation based upon adjusted EBITDA. There might be many things that can be done to improve upon this amount.

The Success Team™ will need to discuss the periods of time for the adjusted EBITDA calculations. There are several options:

It is highly recommended that you begin the process of calculating the current value of your company immediately.

We now want to discuss the ways in the next chapter by which you might increase the value of the company before it is presented to potential buyers.

We use our software to calculate the realistic starting value of your company.

Our process works to help build the value of your company.

We calculate and give EBITDA advice.

We give advice, consultation and assistance with internal financial information.

INCREASE THE VALUE OF YOUR COMPANY

Chapter 5: Increasing the Value of Your Business

Excerpt from The Exit Strategy Handbook: The BEST Guide for Selling Your Business

Copyright © 2013 by Jerry L. Mills and B2B CFO, LLC.

The number one reason our deals get delayed or don't happen is declining financial performance. While due diligence is important, and deals blow up in due diligence, it's not the number one reason for delays or blow ups. In rough percentages, the reasons deals are delayed or don't happen are as follows: (1) Declining financial performance (80%), (2) Unresolved issues that pop up in due diligence (10%) and (3) Owners getting cold feet and backing out (10%). Larry Reinharz, Managing Director, Woodbridge International

“Brevity is the soul of wit,” said Shakespeare in Hamlet. His statement rings true with a brief but brilliant statement documented in the previous chapter:

For each $1 that you increase your EBITDA during the valuation year, you should arguably receive an additional $4 to $6 in sale price. Frederick H. Lipman 42

The above principle is used in the example below.

Let's use the example in the previous chapter and assume that you and The Success Team™ of ABC Example Company, Inc. have gone through our process to increase the adjusted EBITDA from $1.2M to $2.2M. Assuming the same multiplier, the before and after values would be as follows:

| DESCRIPTION | BEFORE | AFTER |

|---|---|---|

| Adjusted EBITDA | $1,200,000 | $2,200,000 |

| Multiplier | 5x | 5x |

| Estimated value of ABC Example Company, Inc. | $6,000,000 | $11,000,000 |

The above example illustrates the purpose of this chapter. We will discuss some of the principles of increasing adjusted EBITDA. This should be one of the highest priorities of The Success Team™.

The verb “excel” is one of the most exciting verbs in the English language. The definition is to:

The companies that your company wants to be superior to, outdo, surpass, outclass and outrival are companies that will be competing against your business for your future prospective buyer.

There are measures you can take to increase the value of your business when a sale is imminent - within 18 months or so. There are ways to increase your payday, by millions of dollars in many cases. Just as importantly, there are methods of transforming a marginal business into a saleable one. John H. Brown 43

The Excel Experience™ in the exit strategy process will focus on four items:

We introduced this topic in an earlier chapter of this book, quoting the successful founder & CEO of Crate and Barrel:

Getting distracted is the biggest problem entrepreneurs face. Gordon Segal 44

Below is a story about an owner who was excited about getting a check for $40M at the close of the sale. He became distracted during the process. The sale not only fell through but he was left with $750,000 in expenses from the failed transaction, plus some other unexpected and unpleasant problems.

Chambers stared into the eyes in the mirror. What the hell had gone wrong? Nine months after signing that lovely agreement, all was dashed. The 40 million bucks. The vacation. The retirement party. The graceful exit into the sunset. Gone.

Heaven could wait. He was in hell.

Not only was his $40 million deal deader than Napoleon, but there was much worse news. He had taken his eye off the business to work on the deal, and now the company desperately needed his attention. Dealmaking had been a massive distraction. Instead of focusing on his customers, he was off meeting in mahogany conference rooms with legal eagles and Turnbull & Associates -clad investment bankers. While Chambers was dealmaking and dreaming about how he would spend his part of the 40 million, sales were falling and profits were down. And, with the worst possible timing, his biggest customer had filed for Chapter 11. He had thought that the new owner could worry about ramping up the business again. Now he was the new owner.

To add insult to injury, like the father of the bride when the groom changed his mind on the way to the altar, Chambers still had to pay the wedding expenses. He was the proud owner of $750,000 in broken deal expenses, $300,000 of which was owed to his law firm. 45

Now is the time for you to make a list of the activities and attributes that will help minimize the future distractions. Below is the pyramid of B2B CFO® Finders, Minders and Grinders™.46 It shows a Finder being pulled down to Minding and Grinding activities. The goal during this process is to help you to remove yourself as much as possible from Minding and Grinding activities.

Finders demonstrate some specific attributes that are essential to success. There are numerous terms that can describe the leadership of a Finder:

You will notice that all of the above attributes or functions require “future” action. Hence, Finders are all about the future. 47

Below are some ideas to assist in avoiding distractions and to move forward to the future:

Success usually goes to those who never quit.

Never give in. Never give in. Never, never, never, never - in nothing, great or small, large or petty - never give in, except to convictions of honor and good sense. Winston Churchill, October 29, 1941

It is tempting to quit too early. Too often a business owner will travel 90% of the journey and then sell the business. Yet, there is a strong possibility that the value earned during the last 10% of the journey could be worth more than the first 90%. 48

The idea is to move most of your time during the exit strategy process from Minding and Grinding into Finding activities, as is illustrated below.

We cannot stress enough how important it is that you continue to operate your company as if no sale were pending. Why? Sales fall through. Given the possibility that you may own your company longer than you anticipated, it makes sense for you to keep it running as profitably as possible. John H. Brown 49

The graph on the next page compares periods of time during the exit strategy process. It shows trends of sales and adjusted EBITDA. It compares the desirable to the undesirable trends.

There is a significant difference between being the visionary who causes sales to increase and being involved in the day-to-day sales process. Most buyers view the latter as highly negative.

Your job as an entrepreneur is to hire salespeople to sell your products and services so you can spend your time selling your company.

An acquirer will want to see that you have a product or service that can be sold by salespeople in general and not just one superstar salesperson. John Warrillow 50

Your job as a visionary is to be the catalyst to increase future sales. It is also to see if the company can diversify its sales. This may cause investment of time in software, research and development and in building a more competent sales process.

Again, the goal in The Excel Experience™ is to do the following as it relates to increasing sales and in the diversification of sales:

You want and need to do better than whatever your competition is doing. You have the innate God-given talent. Now is the time to see if you have the fire-in-the-belly to be the catalyst for future change.

It is important to remember that you are the person who will benefit the most when you cause sales to increase during the exit strategy process.

Increasing and diversifying sales is not the end-all solution to improve the opportunity to sell the company. Efforts must be made to improve certain processes and efficiencies. You and The Success Team™ want to focus on the desirable line of the adjusted EBITDA section of the graph below.

Below is a comparison of how Business A was able to keep focused, but simultaneously Business B lost focus.

Business A and Business B each have $3 million of EBITDA, are located in the same city and are in the same business.

Business A has a strong management team motivated by an economic incentive to both improve company performance and remain through any ownership transition. Business A has developed and documented various systems designed to sustain the growth of the business apart from its owner. It has carefully diversified its customer base in the years leading up to the sale process: no customer represents more than 8 percent of its revenue.

Business B has a good management team, but they are the same age as the owner and have expressed a desire to leave the business when he does. The company's systems are not documented; rather they are “between the ears” of the management team. Business B has six customers.

Which company is worth more? Which would you pay more for? 51

Frederick D. Lipman explained the following factors that influence valuations. Some include the subject of increased revenues and some involve improvements of processes and efficiencies. 52

| Factors Increasing Valuation | Factors Decreasing Valuation |

|---|---|

| Strong customer relationships on all levels | Weak customer relationships and frequent turnover |

| Proprietary products or services | Lack of proprietary products or services |

| No single customer accounts for more than 5% of revenues or profits | A single customer accounts for over 15% of revenues or profits |

| Strong management team (important to financial buyers) |

A weak management team (so-called “one-man-show syndrome”) |

| Excellent employee turnover and relations | Poor employee turnover and relations |

| Consistent revenue and earnings trends | Inconsistent revenue and earnings trends |

| Plant and equipment in good repair | Plant or equipment has been neglected and requires significant repairs |

| Intellectual property assets, which are legally protected | Lack of legally protected intellectual property assets |

Some of the improvements in efficiencies and processes might include someone on The Success Team™ overseeing detailed analysis of:

The goal in The Excel Experience™ is to do the following as it relates to improving processes and efficiencies:

You want and need to do better than whatever your competition is doing. For example:

Owners who focus on maximizing their company's gross margins often unlock substantial value. By definition, this means maximizing cost of goods sold. The best investment most owners can make is upgrading the company's purchasing function.

Professional materials management pays for itself many times over and helps create market value. Companies can benefit greatly from installing cutting-edge inventory management and other throughput management systems. 53

Below is a copy of the table used at the beginning of this chapter.

| DESCRIPTION | BEFORE | AFTER |

|---|---|---|

| Adjusted EBITDA | $1,200,000 | $2,200,000 |

| Multiplier | 5x | 5x |

| Estimated value of ABC Example Company, Inc. | $6,000,000 | $11,000,000 |

Let's assume the “after” column increase in adjusted EBITDA is due mostly to your efforts in increasing sales and from creating new sales through diversification. Let's use the amounts in the “After” column and assume some improvements in processes and efficiencies. The table below shows the possible effects of improvements in processes and efficiencies in categories of percentages from 10% to 20%.

| DESCRIPTION | 10% | 15% | 20% |

|---|---|---|---|

| Adjusted EBITDA | $2,200,000 | $2,200,000 | $2,200,000 |

| Increase in adjusted EBITDA due to improvements in processes and efficiencies | 10% | 15% | 20% |

| Adjusted EBITDA, increased to | $2,240,000 | $2,530,000 | |

| Multiplier | 5x | 5x | 5x |

| Estimated value of ABC Example Company, Inc. |

$12,100,00 | $12,650,000 | $13,200,000 |

Imagine the value you might be able to add to your company with a combination of increases in sales and improvements in processes and efficiencies!

It is highly recommended that you ask the members of The Success Team™ to give ideas and suggestions to help your company improve its processes and efficiencies. A plan should then be implemented to achieve those ideas.

Branding is complementary to the subject of increasing and diversifying sales. An objective review of your company's brand as it compares to the competition might be a good subject for The Success Team™. You might consider hiring a marketing company that has a good reputation for evaluation and creating brands and branding solutions. As an example, our principle brand, the B2B CFO GamePlan®, is below. It clearly helps separate our company from the competition. Very few words need to be stated when people see our brand. People easily understand what we do and what makes us different from everyone else.

The next chapter explores the issues related to the last customer you will ever have: The future buyer of your company.

Our processes help build the value of your company.

We use the Finders, Minders & Grinders process from our three published books.

Our Goal is the help your company increase its sales volume and EBITDA value.

We help with internal financial information.

We assist external CPAs as they examine the financial statements of your company.

BUILD THE SUCCESS TEAM™

THE SUCCESS TEAM™ INCLUDES

BUSINESS OWNER

B2B CFO PARTNER

M&A / INVESTMENT BANKER

TAX SPECIALISTS

WEALTH MANAGERS

INSURANCE ADVISOR

BANKER

AUDITORS

IT SPECIALIST

KEY EMPLOYEES

APPRAISER

ATTORNEY

DIRECTORS, EXECUTIVE COACHING ORGANIZATIONS, ETC.

Chapter 3: The Success Team™

Excerpt from The Exit Strategy Handbook: The BEST Guide for Selling Your Business

Copyright © 2013 by Jerry L. Mills and B2B CFO, LLC.

Your first step should be to assemble an outstanding professional team to advise you. Most business people select their professional team on the eve of their sale. This is far too late in the sale process. By selecting your professional team several years before the target date for your sale, you can obtain their guidance in the presale years as to methods of minimizing the obstacles. Frederick D. Lipman 18

On the next page are the team members we recommend for The Success Team™ and a brief description of their roles during this process.

The Success Team™

| Title | Role | Goal |

|---|---|---|

| Business Owners | Direction and final decisions | Increase sales and company value |

| B2B CFO® | Team Manager | Coordinate the Team, assist with process |

| M&A Company or Investment Banker | Advice about potential buyers | Find the best buyer |

| Attorney | Legal | Legal documentation and advice |

| Tax Specialists | Tax planning | Tax planning |

| Auditors | Auditing | Examine financial statements |

| IT Specialists | Software and hardware | Documentation and advice |

| Wealth Manager | Money management advice | Pre-sale advice and post-sale wealth management |

| Appraiser | Appraise the company | The business value and the primary methods of valuation |

| Insurance Advisor | Insurance advice | Advice on current and future risks |

| Banker | Lending advice | Assist with lending activities |

| Key Employees | Support | Information and transition |

| Directors, Executive Coaching Organizations, etc. | Advisory | Advice and consultation |

(Finder)

We discussed the idea in the introduction to this book that the business owner is the Finder in the business. This is the most important role on The Success Team™ during the exit strategy process. The business owner is the Finder and the principal roles in the company are to be:

The entrepreneur, the visionary, the leader, the idea generator and the catalyst for future change. Finders work in the future. 19

This is your business. You are in charge. Your most effective role on The Success Team™ is to:

Many business owners get distracted during the exit strategy process and find themselves involved in performing administrative tasks (Minding). This is a serious mistake. The business owner should continue to increase the value of the business. This is typically done by continued focus on those things that increase the future value of the business. Those activities are typically increasing sales, finding new customers, building better relationships with current customers, etc.

We will spend time on topics such as earnings before interest, taxes, depreciation and amortization (EBITDA) later in this book, which can be a key method to determining the value of your business. An author has stated the following about increasing EBITDA during the exit strategy process:

For each $1 that you increase your EBITDA during the valuation year, you should arguably receive an additional $4 to $6 in sale price. Frederick H. Lipman 20

Mr. Lipman is suggesting that for each $1 million you increase EBITDA during the exit strategy process, you should see an additional $4 million to $6 million in sales price!

We propose that there is nobody on The Success Team™ who has your talent and drive to increase the future sales price to this degree. We recommend you delegate important tasks to others in The Success Team™ and keep your focus on increasing the value of the company. That is, after all, the best use of your talents.

Most exit strategy experts recommend hiring an outside person to lead The Success Team™.

Retain a point person. Even with an inside sale, I believe a third party point person is essential. Rick Rickertsen 21

There is no requirement that the Team Manager be an outside person. There are, however, some advantages to hiring an outside nonemployee as the Team Manager. This person:

We recommend the Team Manager use this book and the accompanying dashboard software to help manage The Success Team™.

The role of this team member is to find the right buyer for your business. As one author states:

They act as sage counsel, uncover a large universe of buyers, run your auction, take on the role of the bad guy so the business owner doesn't have to. They run great interference and know how to play buyers off against one another to get you the absolute best deal. And they normally can smoke out when a buyer is not real, which can save you huge amounts of time and money. Remember, their fees are nearly all success-based. They only get real money if you get real money. 22

These companies will ask you to sign a lengthy and binding contract. They will want exclusivity from their competition. This means you must carefully consider hiring the right company. The attorney on The Success Team™ should be involved in this process and should review all documents prior to signing.

The attorney hired to be on The Success Team™ should be experienced in exit strategy sales transactions. There will be many documents and much advice needed from this professional.

One of the key documents this attorney will create or review for you is the confidentiality and nondisclosure documents to be signed by the potential buyer. It is paramount that you not divulge trade secrets, key information about customers and other critical information until the attorney and other team members feel you have as much protection as possible in dealing with potential buyers.

In short, no document should be signed in the exit strategy process without the review, input and advice from the attorney on The Success Team™.

Tax specialists are tax attorneys and Certified Public Accountants (CPAs) who are specialists in taxes in the following areas:

The role of the tax expert is more than simply calculating the net cash available to you after the sales transaction. This professional's role is also to look for and advise you regarding any unrecorded or potential taxes that may possibly be a surprise to you prior or subsequent to the sale.

Taxation is usually a very frustrating part of the exit strategy process. Many business owners assume they will receive capital gains treatment on the sales proceeds. They frequently are surprised to know that there are often material items in the transaction that receive ordinary income treatment, such as the recapture of accumulated depreciation.

No purchase offer should be seriously considered until the tax specialists of The Success Team™ have had adequate time to thoroughly calculate and educate all members of the team on all potential tax issues that might occur prior or subsequent to the sales transaction.

The buyer may require an examination by an independent CPA firm for two or three years prior to the sale. The buyer will rely on the examinations performed by the independent CPA firm to determine if the financial statements of your company have integrity.

The lack of financial integrity is one of the most common hurdles encountered during the sale process. In addition, the best way to demonstrate the sustainability of your company's earnings is to have its historical financial statements audited by an independent, certified public accounting firm. An audit demonstrates to the potential buyers that the historical information can be relied upon when making judgments about buying the company based on historical cash flows. It is very important to have your CPA review your current financial statements and practices so that any financial irregularities or inadequacies are immediately exposed and corrected. John H. Brown 23

One of the most difficult decisions you and The Success Team™ will have to make is whether you should hire your own auditors or allow the buyer to hire their own auditors. There are pros and cons to each of these decisions, which will be discussed in a subsequent chapter of this book.

The IT specialist is a very important member of The Success Team™.

This professional will advise the other team members regarding certain important information about the company, such as:

The Success Team™ should work together to hire the best person or company possible to provide this function in the exit strategy process.

Many business owners wait until the transaction closes before they talk to their wealth manager about their options to invest the net cash from the sales transaction. This delay in talking to the wealth manager could possibly be the largest mistake you could make during the exit strategy process.

(Baby) Boomers need a lot of money when we leave our companies because we will live longer than our parents did and we want to be active. Living longer and more actively means we need more money than we may have originally thought.

After you leave your company. The challenge is to create a nest egg big enough to (1) cover the expensive medical care, including even more life extending and quality of life treatments, (and if not that, the expensive health insurance premiums) we'll want and need as we age; and (2) last until we die.

We Boomers have a lot of living left to do and we want to live well.24

Wealth managers should be brought into The Success Team™ early in the process. These professionals need to work with the tax specialists and others on the team. They will need to know the estimated value of the assets that will be available after taxes to provide for your financial future. It is also important for them to hear if the auditors feel significant adjustments will be made that might impact the value of the sale.

Additionally, they need to work with the M&A firm/Investment Bankers to understand what type of buyer will eventually purchase your company.

Wealth managers also need to know if the purchase price will be all cash or if there will be a note payable. Most importantly, these professionals need time with you to find out what your post-sale goals and needs will be in order to ensure that you will be able to accomplish those goals and needs from a financial perspective. Wealth managers will be very focused on your quality of life once the sale of your company has been completed. They will work with you and your future generations to preserve and grow the liquidity that is created by the sale both now and in the foreseeable future.

As you navigate the exit planning process, Morgan Stanley has wealth management resources that may be of assistance to you. For further information you can visit the following website www.morganstanleyfa.com/brunnerfoxgroup/businessservices.htm.

Your company will want to receive a preliminary appraisal prior to bringing in a potential buyer. The Success Team™ will help advise you on the timing of this appraisal.

You can look at this process as similar to that of selling a home. Let's say you want to sell your home for a certain sales price. It makes sense to receive a preliminary appraisal before spending too much money on fixing up the home and putting it on the market.

An appraisal of your business, which specifies the primary valuation methods and factors, should be sought from a qualified appraiser well in advance of the expected sale date. Such an appraisal could cost as little as $5,000 to $10,000. Select the appraiser by reputation and personal recommendation.

What is important is not so much an appraisal of what your business is currently worth but rather an understanding of the primary methods of valuation and valuation factors. 25

The timing of this appraisal should be decided by The Success Team™. The entire team could then use the assumptions and information used in the appraisal to determine a strategy to be used for the exit strategy process.

The insurance advisor's role in the exit strategy process is to help The Success Team™ with certain documentation and planning.

The documentation will relate to the location and termination dates of certain important insurance policies, such as property and casualty, general liability, automobile, errors and omissions, directors and officers, key man life, disability, health, business interruption, bonds, umbrella, workers compensation, etc. It is important for the insurance advisor to advise The Success Team™ so that these and other important policies remain in effect during the exit strategy process and through the close of the sale transaction. The insurance advisor may recommend that some insurance policies remain in place after the close of the sale transaction.

An important role of the insurance advisor is to assist The Success Team™ in preparing for the unexpected events. The age-old adage applies with this professional, “Hope for the best and prepare for the worst.”

Numerous unplanned events may take place during the exit strategy process, and it is wise to be as prepared as possible for them:

The insurance advisor should be aware of the plans and activities of The Success Team™ to help them achieve their exit strategy goals.

Bankers are seasoned business advisors. Many have seen their customers go through an exit strategy.

Nobody can predict the date when your company will be sold. The process may take a few months or a few years. Your company needs to continue its operations on a day-to-day basis, and bankers are an integral part of helping the company with its operational lending needs.

One of the key principles in this book is the concept of increasing sales to increase company value prior to the sale. Bankers understand that increases in sales often negatively affect the cash flow of the company. They realize that increased sales will cause increases in accounts receivable, inventory, fixed assets, overhead, etc., which often cause a decrease in cash.

Bankers should assist your company through this process to help with increases in lending of lines of credit and other loan instruments.

It is easier for bankers to know your company's lending and banking needs if they are a part of The Success Team™. This gives them the opportunity to understand the needs of the company and to possibly act quicker on creating loan instruments.

The business advice of these experienced veterans is often very valuable, and their input should be asked throughout the exit strategy process.

Bankers can also help fund some of the purchase. Your banker should be considered as a possible resource to assist with the funding of the transaction with the buyer.

Key employees can make or break the sale of your business. Some of them will become an important part of the process of assisting The Success Team™ and the transition subsequent to the close of the sale. These employees will eventually hear about your desire to sell your business. Some of their immediate concerns might be:

The Success Team™ needs to advise you about how to deal with key employees before they are told about your desire to sell the business. One author provides the following advice:

Don't issue stock options to retain key employees after an acquisition. Instead, use a simple stay bonus that offers the member of your management team a cash reward if you sell your company. Pay the reward in two or more installments only to those who stay so that you ensure your key staff stays on through the transition. John Warrillow 26

The Success Team™ might consider advising you on matters such as the following:

Dealing with key employees should be very high on the planning list of The Success Team™.

Some business owners have relationships with outside individuals and/or organizations. These might include a board of directors, an executive committee, an executive coaching organization, etc. The business owner might consider the expertise of these individuals and/or organizations when deciding whether to include them on The Success Team™ because they might have a very positive influence during the process.

We assist with your goals and help build The Success Team™.

Our B2B Exit® Software tracks the assignments.

Our B2B Exit® Software's dashboard tracking puts you in control of the process at all times.

Members of The Success Team™ prepare and document everything necessary.

We assist internal employees and external advisors during the entire process.

PREPARE FOR THE LAST CUSTOMER

The Success Team™ process helps find the buyer or seller.

The Advanced Due Diligence Process™ helps prepare the buy or sale transaction.

We have the process to find the buyer or seller, which may be one of the following:

Strategic

Financial

Private Equity Group (PEG)

Family members

ESOP

Management buyout (MBO)

Family buyout

Etc.

Our software and B2B CFO Team Manager tracks the buy or sale process.

We provide Data Room consultation.

Chapter 6: Preparing for Your Last Customer: The Buyer

Excerpt from The Exit Strategy Handbook: The BEST Guide for Selling Your Business

Copyright © 2013 by Jerry L. Mills and B2B CFO, LLC.

Preparing for Your Last Customer:

The Buyer

A well-prepared business gets more offers, and usually better offers, than does a less-prepared one. A well-prepared business also advances the sale more quickly.

Chances are your business can be improved in ways that enhance a buyer's confidence. The more comfort and trust the buyer has in you and your business, the fewer opportunities a buyer has to question various aspects of the business and negotiate a lower price.

Thomas W. Lyons 54

You'd never sell your products or services without understanding what your customers want. The same goes for your company: to maximize value, you have to know what they want.

Robert W. Scarlata 55

Your attitude toward the subject in this and the subsequent chapters will make or break your ability to sell your business and to sell it at the value you want.

Depending upon your attitude, this may be the most frustrating or the most interesting process you have gone through so far in your career as an entrepreneur.

The reason for this possible frustration can be summed up in two words: Due diligence.

Due diligence will either make or break any future sale of your business. The purpose of this chapter is to help you understand the process so you can move forward to success.

Few buyers will purchase a business without conducting an extensive investigation, generally called due diligence. The key to surviving the buyer's due diligence is understanding what areas of your business the buyer is likely to investigate and being prepared for that investigation.

Frederick D. Lipman 56

The purpose of due diligence on the part of the buyer is to validate the information you've provided to a point where the buyer feels reasonably comfortable and understands the risks involved in the purchase. In virtually every transaction, the buyer's offer is contingent upon the results of the due diligence process.

John F. Dini 57

The due diligence checklists provided by the buyer can easily have 200-300 individual items to be answered. Below are just 19 of 186 questions asked on an actual due diligence checklist.

Owners are usually not prepared for the wide-ranging and numerous questions to be answered during this process, which may become difficult for some owners, such as the following story.

The example below is not unusual and can be used as a learning curve that should be avoided during this process.

“The stream turns into a torrent.”

A successful exit is seldom spontaneous, but the result of a carefully prepared process.

The following scene has been played out countless times: an investor approaches the business owner with an offer that seems attractive. They go out for a wonderful lunch or dinner - the great seduction scene. The personal chemistry is excellent, consensus emerges quickly, and the parties map out a deal on the back of a napkin. They shake hands on the general framework of a deal, perhaps even agree on the value of the business, and depart thinking that the deal is done, subject only to some minor details.

Then the investor starts with his or her Due Diligence. A trickle of questions turns into an endless stream. One set of answers leads to another set of questions. The stream turns into a torrent. The barrage of questions puts serious pressure on company management. The investor becomes frustrated with the slow pace at which the incomplete information is provided, and with the ambiguity or inaccuracy, or perhaps even contradictory nature, of the information received. The owner becomes frustrated with the resources consumed, and often misconstrues the questions as a lack of trust or failing commitment on the part of the investor. If the initial waves of questions are answered satisfactorily, the investor goes on to appoint legal advisors and auditors, who then unleash further extensive waves of newer and even more complicated and more detailed questions. Whole teams of advisors descend upon the company, taking information demands to new heights. Company management is under huge stress - after all, managers have a business to run, yet satisfying the investor turns into more than a full-time job. Tensions mount. More often than not, negotiations break off - sometimes in an emotional or dramatic showdown - or the parties may just give up from exhaustion or frustration. 58

The B2B CFO® process advances due diligence.

Most due diligence is done after a potential buyer has made a preliminary offer. The due diligence process then begins, usually with a very short time frame allowed to the seller. The seller then needs to quickly provide either thousands or tens of thousands of documents under much duress. The seller is also required to invest thousands of man-hours by the owner, management, employees, attorneys and other professionals. The cost of the due diligence to the seller can easily run into six figures. This six-figure amount is usually unbudgeted and can put a significant financial strain on the company's operational cash.

Most owners are shocked by the depth and breadth of the due diligence process. This process of “full and fair” disclosure enables a buyer to verify all provided data and reviews all information about the company. “All” includes anything that would interest the buyer at any level.

Most business owners are highly independent people who find this disclosure process extremely uncomfortable. 59

As a result of constant distractions and time requirements, more often than not, sales and adjusted EBITDA start going down, as illustrated in the graph on the next page.

The distractions in “the stream turns into a torrent” story above are usually the reasons for the “undesirable” results illustrated in the above graph.

The Advanced Due Diligence Process™ has been created to help you with the preparation process before the buyer is approached. Assuming a future buyer's market, you want your company to be better prepared than any other company the buyer might be looking to purchase.

While no guarantees can be made that the buyer will be interested in your business, the principles discussed so far in this chapter indicate that a well-prepared business often has a better chance with a buyer than an unprepared business.

The goal of the subsequent chapters and The Advanced Due Diligence Process™ is not to prepare your company 100% for the due diligence questions to be asked by a potential buyer. That goal is impossible to achieve. All buyers will have their own unique questions, some of which might be specific to an industry.

The goal of The Advanced Due Diligence Process ™ is to have your company prepared 80% to 85% for the prospective buyer. This goal will make the process much easier for both you and the buyer. This goal will also separate your company from the competition to the prospective buyer.

For example, assume the buyer is seriously looking at your company and another that the buyer views as “very similar.” Let's also assume your company is 85% ready for the buyer and the competing company is only 5% ready. Which company, in this scenario, has the competitive advantage with the buyer?

There are several factors that make The Advanced Due Diligence Process™ unique, all of which should work to your advantage:

We can't emphasize enough the importance of using our dashboard software to manage this process. This software is unique and can be a very valuable tool to help achieve your goals.

The future buyer of your business should be viewed as a customer.

Successful entrepreneurs are experts at finding the needs of their customers. They will spend significant resources to find the customer's needs in order to fulfill them. These business owners have significant competitive drive to be the first or the best at meeting the customer's needs, partly in order to receive a financial reward but also to be better than the competition.

And so it is with the future potential buyers of your company. One of them will become the future customer. The goal is not only to sell the company but to sell it at the highest possible price. This means there must be a concentrated effort to find the needs of these future customers who might someday bid for the privilege of buying your business.

You want something from your customer, the future buyer: A very large check.

Your future customer, the buyer, wants something from you: Information.

The balance of this book is to help you prepare the information the future buyer wants in order to help you get what you want. The following chapters are organized as follows in order to help you give the buyer what they need:

The beginning of this process may seem overwhelming. After all, you still have a business to run, customers to satisfy, payroll to meet, and a myriad of other short-term and long-term tasks.

Remembering an adage might be appropriate as you gaze into the future on this new venture:

“When eating an elephant take one bite at a time.” Creighton Williams Abrams Jr.

The Advanced Due Diligence Process™ documented in the remaining chapters of this book contains 200-plus individual tasks. You might consider the following approach after assembling the members of The Success Team™:

Now, onto the next chapter, which is about the importance of the Data Room.

ENJOY THE NEXT PHASE IN YOUR LIFE

We assist the Wealth Manager to determine your future needs from the buy or sale transaction.

We help tax attorneys and CPAs regarding the net amount of cash available after tax payments and/or debt service.

We have experience helping independent CPAs with the examination of internal financial statements, projections, etc.

We can help you through the entire transaction and post-transition.

We provide consultation and advice on any carry back transactions.

Chapter 16: Think Like a Buyer to Exit Profitably

Excerpt from Avoiding the Danger Zone: Business Illusions

Copyright © 2007 by Jerry L. Mills and B2B CFO, LLC.

Branding, Marketing and Public Relations

Checklist

Branding - The subject of branding and selling a business is an interesting topic. In layman's terms, branding is the process of using techniques to grow the business by separating one's company from the competition in a demonstrable and strategic manner. Realizing that most sales transactions fail, one could argue that a business owner should continually try to improve upon the company's brand. Otherwise, a company runs the risk of failing to be distinguished from the competition, which eventually might erode sales and the overall value of the company. This might, in turn, hurt the ability for a future sale to a future buyer.

A buyer may or may not be interested in your company's brand. For example, a strategic buyer, such as a larger competitor, may be interested in buying your customers, processes, employees and other assets in order to gain a larger market share. The buyer may want to roll your company into theirs and completely drop your branding. This makes sense if it meets the needs of the buyer.

A financial buyer may be interested in keeping the brand name. For example, in 2002 a company named Zappos.com had sales of $32M but was not yet profitable. Tony Hsieh, the CEO, made a bold move and decided to change the brand of the company to “customer service.” He stated, We realized the biggest vision would be to build the Zappos brand to be about the very best customer service. 71

The branding solution worked. The company grew tremendously and was sold to Amazon in 2009. As of the time of the writing of this book, the Zappos.com website does not show the name or the brand of the buyer, Amazon. This was clearly a financial purchase by Amazon, which decided that the existing branding of Zappos was important enough to keep the Zappos name instead of rolling it into the Amazon name.

Public Relations - Press releases and other such processes are important to the growth and branding efforts of some companies. For example, our company did not have one press release prior to 2007. We hired a public relations firm, Angles Public Relations, and we slowly began to receive press coverage. Today, we have so much press coverage that we have found it necessary to build an entire website (www.news.b2bcfo.com) just to hold all of the press releases, television appearances, etc. It may be coincidental, but our company has grown more than 400% over the period of time we have been using public relations.

Buyers will want to see your past press clippings and published news articles. They will also want to know if your company has a future public relations plan.

Branding, Marketing and Public Relations Checklist

| # | Subject | Description | n/a | Assigned To | Expected Completion Date | Completed & in the Data Room |

|---|---|---|---|---|---|---|

| 1 | Plan | Describe the company's branding, marketing and public relations plan | ||||

| 2 | Inside | Provide the resumes and job descriptions of any internal graphic artists, marketing, branding and public relations employees | ||||

| 3 | Outside | List the names, addresses and a description of the outside subcontractors used in graphic arts, marketing, branding and public relations | ||||

| 4 | Printed Material | Provide all brochures, literature, forms, catalogs and other material issued to the public and otherwise used in marketing, branding and public relations | ||||

| 5 | Website | Provide any website names and URLs used for or by the company in its marketing, branding and public relations | ||||

| 6 | Trademarks | Provide the trademark names for all trademarks owned or used by the company including the registration number issued by the United States Patent and Trademark Office | ||||

| 7 | Applications | Provide the trademark names for all trademarks applied for, including current printouts of registration status by the United States Patent and Trademark Office | ||||

| 8 | Non-Owned | Detail any trademarks used (e.g., brochures, websites, any printed material) that are not owned by the company | ||||

| 9 | Disaster Plan | Provide a copy of the company's disaster plan in the event of a highly negative public relations issue |

Branding, Marketing and Public Relations Checklist

| # | Subject | Description | n/a | Assigned To | Expected Completion Date | Completed & in the Data Room |

|---|---|---|---|---|---|---|