B2B CFO® will benchmark your company against others in the same industry and then using this information, show you how to Grow Successfully™. This is a must have for any business owner. Get your free Discovery Analysis today (a $1600 value)!

GROW SUCCESSFULLY™

We serve privately-held companies with sales up to $75 Million

Chapter 11: The Danger Zone

Excerpt from The Danger Zone: Lost in the Growth Transition

Copyright © 2006 by Jerry L. Mills and B2B CFO, LLC.

If you look at the graph above you will notice that the cash needs of the company exceed the available cash. This is The Danger Zone. Bluntly put, the future of the company is in jeopardy.

There are dozens of reasons why the cash needs exceed the available cash. I outlined some of those reasons in the preceding chapters, which deal with the outgrowth of the company's infrastructure.

Regardless of the reasons, the company is either in serious trouble or is headed that way.

B2B truism:

The Danger Zone is created when the cash needs of your company far exceed the cash available to meet those needs.

Another Analogy

Let's imagine you have a friend or a relative who is severely overweight. This person's doctor has made it clear that the weight must decrease or severe consequences will follow. This person tells you that he or she has a plan to decrease the weight. The self-created plan from your friend is to increase the daily calories that are to be consumed. Your response might be, “How can you lose weight by increasing the number of calories you have been consuming in the past?” There is no response to your question.

The above is analogous to what happens to Finders when they hit The Danger Zone. They then begin to increase the activities that cause harm to the company. Why do Finders get involved in this phenomenon? Well, this chapter explores the answer to this question.

Controlling the “Finding” Time

The inception of a company is somewhat of a romantic time for Finders. Yes, there are cash flow and other business problems, but the enjoyment the Finder has in the finding activities seems to outweigh other issues. Sometimes, for the first time in their lives, the Finders are actually getting to do what they want to do for a living. Some are golfing with key people; some are thinking and dreaming; some are spending time with intelligent associates working on the details of the dream.

Before the business honeymoon is over, the romantic finding activities give an euphoric sense of fulfillment and joy to the Finders. They can put up with pain from others as long as they can spend the majority of their time in finding activities. The future looks bright to the Finder, even if there is little or no cash in the company.

The business honeymoon is over when the Finder stops spending most of his or her time in finding activities. Seemingly overnight, the Finder is spending most of his or her time doing administrative and other non-finding activities.

B2B truism:

We have yet to see a Finder start a business so he can spend his time on accounting and computer problems, yet far too many spend too much time doing those things.

What went wrong after the business honeymoon? Well, the weight of the infrastructure has caused the Finder's time to shift to non-finding activities.

Figuratively speaking, instead of spending time on things that used to be fun, the Finder is now spending each day of the week cleaning out the garage and raking the leaves in the yard.

The Finder's Time Shift

So, the trend slowly moves from being a Finder toward becoming a Minder.

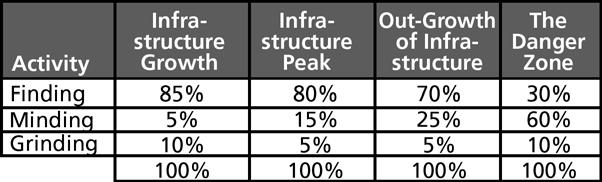

The Finder's time shift is predictable during these transitional phases. The following information should not be viewed in terms of absolutes but as observations of trends, based upon decades of experience watching Finders become Minders during The Danger Zone:

A graph of the shift to minding time would look something like the following:

Activities During the Time Shift

You will recall that in Chapter 9 we discussed that a Finder's principle goal is to build relationships that cause the company to grow.

We identified a few things that Finders do during the Infrastructure Creation period of the company, such as:

During the time shift from finding to minding we see the Finder do less and less of the above.

Instead of finding, the Finder starts minding activities such as:

A person might ask, “What is wrong with these activities?” Good question, which is easily answered:

Consequences of the Time Shift

During The Danger Zone, the Finder is dealing with infrastructure “weight” that distracts and then eventually destroys. The destruction may be in several forms, such as:

The destruction items above do not include the damage to employees, families of employees, vendors and other relationships of the Finder.

Why Does a Finder Become a Minder?

Why do you think that Finders stop doing what they love to do, which are finding activities, and start doing what they hate to do, which are minding activities?

The answer to the question is very simple; however, the discipline needed to find the solution to the problem may be complex. Most likely, the Finder will need outside help during The Danger Zone.

I Will Fix the Problem

Most Finders are A+ personalities. Many were in athletics when they were younger and are very competitive. Most have helped the company grow from the sheer efforts of their personalities and skills. Problems, some of them of a serious nature, have arisen in the past. When those problems arose, the Finder jumped in with both feet and solved the problem. Presto! Job completed!

The Changes Are Not So Easy This Time

The infrastructure problems of the company are not so easily fixed today. There is too much weight from infrastructure problems with customers, vendors, employees, subcontractors, computers, bankers, governmental agencies, cash shortages and so forth. More knowledge on how to fix the infrastructure is needed than presently exists within the company.

Someone to Trust

Finders often do not delegate certain tasks to people simply because they do not trust others within the company. In this situation, we need to ask two questions:

The solution to the dilemma may be a difficult one to find if the Finder is the reason for the lack of trust. Sometimes the lack of trust is because the company does not have written policies and procedures (infrastructure) that give comfort to the Finder that the job will be done correctly. Often, the Finder feels that nobody can do the job correctly. Sometimes the Finder simply has an issue with trust. If this is the case, it may be good for the Finder to find a confidant to whom he can talk about this trust issue. Ultimately, the Finder must delegate tasks to people in order to grow the company and to escape The Danger Zone.

B2B truism:

The Finder must learn to trust people. Employees should be terminated from the company if they are not trustworthy.

Sometimes the trust issue is because of the prior actions of the Minder or Grinder. If the lack of trust is because the Minder or Grinder has stolen or cheated the company, the next action step is very simple to identify: Fire them – even if they are family members. The Finder wants such a person working elsewhere, hopefully for the competition. It is a rare situation in which the Finder will be able to rehabilitate dishonest employees. If the Finder has dishonest employees, even family members, the Finder has only one course of action, and that is to terminate the relationship and hire someone who is trustworthy.

B2B truism:

Good management is the accomplishment of the goals and objectives of the company through the actions of other people.

Chapter 12: Escaping The Danger Zone

Excerpt from The Danger Zone: Lost in the Growth Transition

Copyright © 2006 by Jerry L. Mills and B2B CFO, LLC.

Ideally owners of closely held businesses will read this book and apply its principles before their company arrives in The Danger Zone (TDZ). I realize, however, that some business owners may be in this condition before they pick up this book. We need to now address how to get out of The Danger Zone.

Future Sales With the Right Margins

One of two things will happen with a company that enters TDZ: Sales will increase or decrease.

Sales will not stay flat.

A Finder who will leave minding enough to increase sales (with good profit margins) might have some likelihood of escaping TDZ.

Cash or Sales?

Which came first: The chicken or the egg? Which comes first in the TDZ: Sales or cash?

The answer to this question for the Finder is obvious. The Finder will need to find sales and other people will need to find cash. This is where the discussion in earlier chapters of this book about surrounding yourself with senior-level executives is very important.

B2B truism:

During TDZ, the Finder finds sales and the senior-level executives of the company find cash.

The Danger Zone Results

The options for a company that enters TDZ are limited. A few of the options are:

B2B truism:

Leaders make tough decisions. There is no benefit in shuffling chairs on the deck of the Titanic. Leaders look to the future and avoid the icebergs that are in the path of their company.

The Shift from Minding to Finding

Ultimately, the Finder must leave minding to others to escape The Danger Zone. This shift will take discipline and, possibly some money. There is no choice in the matter. The Finder must find someone who can watch over the minding activities of the company. My book, Escaping the Danger Zone, explains more about this subject.

Please click on the tabs below for more information about the B2B CFO GamePlan®

The people we serve

We serve owners of companies with revenues up to $75 million that want to increase cash, profitability, sales and company value.

Our attitude of respect

We recognize the wisdom of the adage, "The world consists of two types of people, those who act and those who are acted upon." We realize you are of the former group.

Entrepreneurs are the geniuses of our generation. With approximately 330 million Americans in the United States, your group, entrepreneurs and business owners, consists of about 8% of the population of our great country. Yet despite that small percentage, you and your peers employ 70% to 75% of the W-2 employees of our nation! As such, we understand that the future economic recovery of our country rests upon your shoulders.

We recognize the complexity of that burden and want to help you, even if it is, seemingly, in a small way. For it is often from small things that great things derive. The acorn seed is smaller than a quarter, but it can give birth to the Oak tree which can grow more than 60 feet in height and live for centuries. And so it is with business owners.

Are you familiar with the story of Hewlett-Packard? Today, it's one of the world's largest information technology companies. But what you might not know is that the company was created with just $900 in a one-car garage by two entrepreneurs, Bill Hewlett and Dave Packard. They were entrepreneurs with a seed of an idea. They risked all they had on their idea and achieved great success.

Why did you start your business?

We often ask business owners the question, "Why did you start or buy your business?" This is a fun question to ask because of the diverse reasons owners give. Some of the responses are:

We refer to you as a 'Finder'

Our firm has its own distinctive terminology, which refers to you and your peers as 'Finders'. We've even written about your characteristics in our book, The Danger Zone:

Finders are the leaders of the company. They are not necessarily the people who lead all company employees on a daily basis. Finders demonstrate the type of leadership that "pulls" people into the future - employees, current customers and future customers.

Finders demonstrate some specific attributes that are essential to this success. There are numerous terms that can describe the leadership of a Finder; the following few will give you the main idea.

You will notice that all of the above attributes or future functions require action. Hence, Finders are all about the future. They do not live in the past. They view the past as a tool from which to learn, not as a place in which to dwell (The Danger Zone, Lost In The Growth Transition, pp. 25- 26).

Finders often become frustrated

It is our experience that Finders often become frustrated with the day-to-day grind of running a business, which often takes them away from their original goals of starting the business.

The B2B CFO GamePlan®

The purpose of the B2B CFO GamePlan® is to help Finders either get on track or keep them on track with their original goals and objectives of starting and/or purchasing their company. The B2B CFO GamePlan® consists of six separate steps:

The Discovery Analysis™

The Strategy Process™

The Strategy Implementation™

The Results Solution™

The Excel Experience™ (Excel – to do extremely well, surpass, outclass, outrival)

The Exit Strategy™

What's the next step?

We invite you to call upon one of our professionals to deliver a complimentary Discovery Analysis™ of your company. The process is confidential and will not take much of your time.

Something about our professionals

B2B CFO® is unique. Unlike a full-time chief financial officer or part-time CFO (interim CFO, temporary CFO, fractional CFO, contract CFO, or other companies that provide CFO services), we create long-term, professional relationships on an affordable, as-needed basis. Services are provided objectively by seasoned partners who average 25 years of experience.

We can help with the simple things, such as helping to improve cash flow, or the more complicated matters, such as a business exit. As you'll discover, with more than 6,000 years of collective experience and a multitude of national partnership resources, there isn't much we can't do for you.

Article Source: The B2B CFO GamePlan®

REDUCED CASH FLOW WORRIES

Our emphasis on cash-flow projections and working capital improvement is geared to help you reduce your cash-flow worries.

In chapter four of our book, Avoiding The Danger Zone, Business Illusions, we explain how increased sales do not always equate to increased cash. Our experience will help you through this phenomenon.

Our goal is to assist with your banking and lending needs, which will help bankers understand those needs. We also can communicate on your behalf with bankers and lenders.

We can assist the internal staff with your company's cash-flow management, which will help the goal of reducing your cash-flow.

Chapter 4: The Illusions of Increased Sales

Excerpt from Avoiding The Danger Zone: Business Illusions

Copyright © 2007 by Jerry L. Mills and B2B CFO, LLC.

Do Not Assume The Enemy Will Not Come – Sun Tzu

Sun Tzu was a successful Chinese general in approximately 500 BC and is credited for writing The Art of War. He said:

Conquerors estimate in their temple before the war begins. They consider everything. The defeated also estimate before the war, but do not consider everything. Estimating completely creates victory. Estimating incompletely causes failures. When we look at it from this point of view, it is obvious who will win the war.

Do not assume the enemy will not come. Prepare for his coming. Do not assume the enemy will not attack.

Most business owners assume that as sales increase, cash will increase accordingly. This is an illusion. The opposite is usually the case - as sales increase, cash decreases.

Referring to Sun Tzu's comments above, your enemies will become those who attempt to take cash away from you and your company. The competition for your cash will be fierce and extreme. The attacks on your cash will become frequent and constant.

An analogy: Visualize a dam, brimming with water that generates electricity. Liken the dam to your bank accounts and the water behind the dam to the cash that accumulates in those accounts.

A dam, preserving an abundance of water, releases the water in a controlled manner, which not only preserves the proper level of water but also generates electricity (power) through the controlled release process.

Likewise, preserving an abundance of cash, released in a controlled manner, allows the company to operate and helps preserve equity (power) for its owner.

Left unprotected, the elements will attack a dam possibly causing dangerous cracks. These cracks, if left unattended, may cause the dam to break, thus letting the water escape its protection. The generation of electricity (i.e. money) ceases or is diminished. Valuable resources must then be given to fix the dam in an attempt to restore it to its pre-damaged state.

Likewise, left unprotected or without an adequate working capital plan, your cash will escape the safety of your bank accounts. The ability to generate sales (i.e. cash) will diminish or cease. Valuable resources will be given to fix the problems that caused the cash to evaporate in an attempt to restore the company as it was before the damage was done.

Paraphrasing the words of Sun Tzu:

Business owners estimate in their offices before a sales increase begins. They consider everything related to cash. The defeated competition also estimates before their sales increase, but do not consider everything. Estimating completely creates cash victory. Estimating incompletely causes cash failures. When we look at it from this point of view, it is obvious which company will win the cash war.

Do not assume the enemy of your cash will not come. Prepare for his coming. Do not assume the enemy will not attack your cash.

I really like Sun Tzu's comments about estimating. This is very wise advice and is much easier to accomplish than you might think.

Most business owners have a good gut-feel on the amount their sales will increase over the next year or two. They are amazingly accurate with these sales assumptions. This accuracy is usually based upon their knowledge of customers, contracts, proposals and other things that give them a safe assumption on their sales projections.

Where the owner stumbles is in estimating the amount of cash that will be needed to function properly with the increased sales. The failure to estimate accurately regarding future cash needs (working capital) can cause a business to GROW OUT OF BUSINESS AND FAIL.

A company in a growth mode cannot survive without adequate working capital. This usually means a line of credit from a bank that will help the company with the ebbs and flows of cash so it can pay its bills, make payroll, etc.

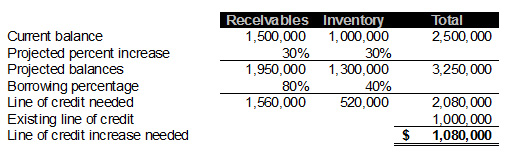

Below are some general rules of thumb to help you with this issue. The actual numbers are not important. What is important are the principles behind the numbers to help you with the estimating process. For illustration purposes, let's assume the following:

| Last year's sales | 10,000,000 |

| Projected sales increase next year | 30% |

| Trade receivables | 1,500,000 |

| Inventory | 1,000,000 |

| Current line of credit ceiling | 1,000,000 |

Based upon the above numbers, what is the minimum amount needed for a working capital line of credit from a bank?

We first need to realize that the company is starting at a disadvantage. The current ceiling on the line of credit is $1,000,000, which is inadequate! Bankers are infamous for being conservative on giving adequate lines of credit to business owners. An inadequate line of credit can have the effect of choking a company's cash. Conservatively, the current line of credit should approximate:

| Receivables | Inventory | Total | |

|---|---|---|---|

| Current balance | 1,500,000 | 1,000,000 | 2,500,000 |

| Borrowing percentage | 80% | 40% | |

| Borrowing base should be | 1,200,000 | 400,000 | 1,600,000 |

| Borrowing available | 1,000,000 | ||

| Underfunded existing line of credit | $(600,000) |

We see from the above that the company already has a working capital deficiency of $600,000 on its current line of credit. While this is unacceptable, you would not want to make an appointment with your banker and ask for a $600,000 increase in the line of credit. This would be a mistake. Rather, it is time to follow Sun Tzu's advice and do more estimating on what is really needed.

Looking forward, we can estimate the approximate amount of working capital line of credit needed for this next year, assuming that both receivables and inventory will increase 30% along with the projected increase in sales.

Thus we see that you should meet with the bank and ask for a line of credit of approximately $2,100,000. A negative response from the bank is unacceptable because without an adequate working capital line of credit, your business could suffer.

Let's assume you follow the above advice and obtain an adequate line of credit. By no means are you out of the woods. Cash will start evaporating unless it is controlled. It is time to do a little more estimating and planning.

Cash is like water; it constantly flows but not always in the direction you want.

Owners constantly ask me, “Jerry, where has my cash gone?” This is a natural question that is easy to answer – if you know what to look for. Unfortunately, few business owners are trained to read their raw business instruments.

Your cash can follow many avenues of escape. As your sales grow, you run the risk of your cash going to the following:

The following is a brief but important discussion of the first three items on this list; trade receivables, employee theft and inventory.

I do not want to get into a granular discussion of items such as the average day's collection of receivables and so forth. Rather, I would like to share some insight that might give you an edge by avoiding a potential cash quagmire.

Employee theft is rampant. It is a spreading disease that seems to have no cure. There is a remedy for smart employers who do some planning to prevent theft, but it is an illusion to assume that theft is not or will not happen in your business.

Whether your business is manufacturing, retail, wholesale, service, hospitality or high tech, it is probably experiencing some degree of employee theft. The list of items employees steal from their employers is endless and includes such items as inventory, money, parts, components, supplies, information and customers. In fact, it is estimated that 95 percent of all businesses experience employee theft and management is seldom aware of the actual extent of losses or even the existence of theft.

Studies by the Department of Commerce, American Management Association and other organizations estimate that employees steal over a billion dollars a week from their unknowing employers. Other studies estimate that nearly one-third of all bankruptcies are caused by employee theft, and it takes approximately $20 in sales to offset every $1 lost to theft. Often management has indications of the problem through declining profits, unexplained inventory shortages, rumors and many other signs.

My book The Danger Zone: Lost in the Growth Transition documents employee theft cases that have been uncovered by my firm. Chapter Six is titled “Tempting a Good Person,” and explores the concept of how even the most trusted employees, even relatives, can steal from us if the temptation to steal is too great. Here is one example from that book:

About three weeks after being hired by a retail company, I became weary of the controller not giving me the bank reconciliations. I talked to the owner of the company and was able to obtain copies of bank statements from the company's bank. I had a different staff person help me reconcile the bank statements. We discovered that the controller had a three-person scheme to steal from the company. The controller would write a check to one of the company's vendors and hand deliver the check to a friend. His friend would take the check to a bank teller who would cash the check. The three people (the controller, the friend and the bank teller) would then split the cash proceeds. The thieves were caught by the work performed by my firm. Some relatives of the dishonest controller personally borrowed money and paid the owner about $250,000. To my knowledge, the crime was never reported to the authorities.17

Hans Christian Andersen published The Emperor's New Clothes in 1837. A condensed version of the story reads as follows:

Many years ago, there lived an emperor who was quite an average fairy tale ruler, with one exception; he cared much about his clothes. One day he heard from two swindlers named Guido and Luigi Farabutto that they could make the finest suit of clothes from the most beautiful cloth. This cloth, they said, also had the special capability that it was invisible to anyone who was either stupid or not fit for his position.

Being a bit nervous about whether he himself would be able to see the cloth, the emperor first sent two of his trusted men to see it. Of course, neither would admit that they could not see the cloth and so praised it. All the townspeople had also heard of the cloth and were interested to learn how stupid their neighbors were.

The emperor then allowed himself to be dressed in the clothes for a procession through town, never admitting that he was too unfit and stupid to see what he was wearing. He was afraid that the other people would think that he was stupid.

Of course, all the townspeople wildly praised the magnificent clothes of the emperor, afraid to admit that they could not see them, until a small child said:

"But he has nothing on!"

This was whispered from person to person until everyone in the crowd was shouting that the emperor had nothing on. The emperor heard it and felt that they were correct, but held his head high and finished the procession.18

But who was at fault for such an embarrassing situation? Was it the two swindlers? Was it the two trusted men sent by the emperor to test the new clothing? Was it the emperor? Was it all the townspeople that wildly praised the magnificent clothes?

The answer? Everyone except the small child.

This “at fault” issue is applicable to every company that has inventory. With very few exceptions, every company that has inventory has too much of it, so let me explain something about the culprits associated with this business issue. You'll see that, as with the fable of the emperor's new clothes, many people are at fault.

Remember, as sales increase, the demand for cash will increase, and the opportunities for cash to disappear will increase exponentially.

Resolve to follow Sun Tzu's advice on estimating everything related to cash. Hire talented people that share your core values. Create good internal controls to preserve cash.

Any failure to estimate everything regarding cash may cause you to become as the emperor in Hans Christian Andersen's fable – but instead of walking around with no clothes, you will be walking around with no cash.

B2B CFO® will benchmark your company against others in the same industry and then using this information, show you how to Grow Successfully™. This is a must have for any business owner. Get your free Discovery Analysis today (a $1600 value)!

INCREASE COMPANY VALUE

We help with the bank and lending process to find the money you need to grow your company and increase its value.

We can assist your internal team to create timely financial statements so you have the information needed to make key decisions.

Our goal is to help relieve you of certain "Minding" activities allowing you to focus on the increased growth of the company.

We give advice on working capital improvement to help with the capital needed for the company to grow.

Chapter 2: Illusions

Excerpt from Avoiding The Danger Zone: Business Illusions

Copyright © 2007 by Jerry L. Mills and B2B CFO, LLC.

An analogy will help us with this subject of business illusions.

We will compare a business owner with an airplane pilot. The similarity between the two is instructive.

For example, a pilot has two alternatives when the airplane has lifted into the sky: The airplane will either successfully land or it will crash. That is it – there are no other alternatives.

Similarly, a business owner has two alternatives when the business has taken off and is a viable entity: The business will either be a success or a failure. That is it – there are no other alternatives.

There is much to learn about business illusions from pilot crashes.

We are familiar with some of the famous people who have died in airplane crashes: The legendary Notre Dame football coach Knute Rockne in 1931, actress Carole Lombard in 1942, rock star Buddy Holly in 1959, baseball player Roberto Clemente in 1975, country singer John Denver in 1997, and John F. Kennedy, Jr., just two years later.

One of the most highly publicized crashes in recent years claimed the lives of John F. Kennedy, Jr., 38, son of the late president John F. Kennedy; John Jr.'s wife, Carolyn Bessette Kennedy, 35; and her older sister, Lauren Bessette, 37. On July 19, 1999, the Piper Saratoga that Kennedy was piloting plunged into the ocean near Martha's Vineyard.6

Regardless of one's political views, the saga of the deaths of John F. Kennedy and his son, John F. Kennedy, Jr. is tragic. I remember exactly where I was when I heard about the presidential assassination on November 22, 1963. I recall watching the funeral procession a few days later and will never forget seeing a small boy in what seemed to be a dress saluting the casket as it passed by. That boy was the son of the assassinated president, and it was just three days before his third birthday.

JFK, Jr. became a pilot in his mid 30s. We can learn something from the tragedy of his death.

Kennedy was a relatively inexperienced pilot, with 310 hours of flight experience, including 55 hours of night flying and 36 hours in the high-performance Piper Saratoga. He had completed about half of an instrument training course, but was not rated for flying in low visibility conditions. The National Transportation Safety Board investigation found no evidence of mechanical malfunction, and determined that the probable cause was "the pilot's failure to maintain control of the airplane during a descent over water at night, which was a result of spatial disorientation. Factors in the accident were haze, and the dark night." The report noted that spatial disorientation as a result of continued VFR flight into adverse weather conditions is a regular cause of fatal airplane accidents.

According to literature found in most FAA-approved flight training books, a pilot's inability to see the horizon leads to spatial disorientation. The inner ear may give the pilot the impression that the plane is turning when it isn't. It takes many hours of instrument training for a pilot to be able to fly in IFR conditions, conditions that most likely existed when Kennedy was flying on his route to Martha's Vineyard. Over the water at night there are few lights, and those lights that existed were most likely obscured by the haze, resulting in the boundary between sky and water on the horizon becoming difficult to determine.7

So we read that JFK, Jr. died because he apparently became disoriented while flying his airplane. His disorientation caused his death, as well as the deaths of his wife and sister-in-law. Tragic.

From reading several books on this topic, it seems that pilots, both experienced and inexperienced, can be fooled into seeing illusions. I find this topic very interesting, especially because of the risk that is involved in flying an airplane. The ultimate risk is death.

Below are some of the ways a pilot can be deceived by illusions.8

I had a fear of flying in an airplane before I did research and found this information. While I am now more reluctant to get on an airplane, this is how I interpret the above information about pilots' illusions. A pilot can:

So we learn that pilots may be fooled into illusions and may not be able to tell up from down, sideways from forward, and long from short on runways and may get confused about reading their instruments.

I am not a pilot, but I am a good observer of human nature, and I believe I understand what is going on with many of these airplane crashes.

Here is another observer's take on this problem:

There are numerous instances of such accidents, when the pilot deludes himself that he can proceed when he quite clearly cannot. Just as perceptual illusions probably have physiological causes, so the belief that it is safe to cut a corner has psychological ones. The American psychologist Woodworth says that the animal ‘prefers to follow his nose, look at the goal and go where he is looking.' The nearer the goal, the stronger the pull. The nearer the airport, the more hypnotic the drive to continue.9

And here is my conclusion: Some pilot crashes occur because the will to survive takes over at the moment of crisis and causes the pilot to react to his gut-feel about what should be done at that very moment. Instruments, opinions of co-pilots and other information become irrelevant at the moment of crisis because the basic desire to live causes the pilot to do what his instincts tell him to do, even if his instincts are wrong.

As painful as it was for me to learn about pilot illusions, there are numerous parallels to business owners and their illusions. Business owners can:

It is going to take the rest of this book to explain the multitude of business illusions you will face as you experience growth in your business. I would like to conclude this chapter, however, with some fundamental principles about your future success.

Your gut-feel has gotten you where you are today. You should always trust it. However, you should start disciplining yourself to verify facts before you make key decisions based solely upon your gut-feel.

As sales, the number of employees, customers, transactions, vendors and other factors increase, you will find it increasingly difficult to keep facts and figures in your head. When your business was smaller, you were able to do a fairly good job of keeping key information in your head – which, in turn, enabled you to react to situations with your gut-feel. But those days are gone when the company becomes so complex that you can no longer keep everything in your head.

When you reach that point, just as the pilot needs his instruments to fly the plane safely, you will need business instruments to make key decisions.

What is interesting to me about this issue of gut-feel and business decisions is that business success has nothing to do with raw intelligence. Most business owners are above average in IQ, but few would qualify for Mensa. Membership in this society requires an IQ equal to the top 2% of the population.

Let's imagine that we have a business owner who does qualify to be in Mensa and is a certified genius. Now, let's envision this person trying to run a company.

During hectic periods, he receives bad financial instruments from his accountants and management. Specifically, most of the amounts on the balance sheet are incorrect, such as cash balances, receivables, inventory, accounts payable, debt, etc.

What is our genius going to do with this financial information? Well, he is going to make decisions on hiring people, buying equipment, entering into leases, creating expenditures, investing in capital improvements, purchasing computer hardware, investing in computer software, and so forth. What is the likely outcome of the decisions of our genius business owner? That's easy - his business decisions will likely be wrong. Yet, these wrong decisions will have little to do with his intelligence; rather, they will be a result of making decisions using bad financial instruments.

Of course, good decisions also have little to do with IQ. More often they are the result of a gut-feel that is verified by good business instruments and by input from good business advisors. In fact, with better financial instruments and sound business advice, virtually any business owner can beat the competition. It is simply a matter of cause-and-effect.

Vince Lombardi, the legendary NFL football coach, is credited with saying

Excellence is achieved by the mastery of fundamentals.10

Those of us who remember the days when the Green Bay Packers were coached by Vince Lombardi realize that the individual players on his championship teams were not the best in the NFL. As a former Dallas Cowboys fan, it was frustrating for me to see Coach Lombardi's team constantly beat my team, which arguably had much more individual talent. Yet, the team with inferior talent consistently beat teams with superior talent.

How did this happen? Simply put, the Packers had a great coach – one who understood the importance of fundamentals. Coach Lombardi was relentless in teaching the fundamentals. For example, the following was reported about this first training camp with the Packers.

Vince drilled and drilled to polish every facet of the team's performance. He reminded them often that one play might be the crucial one, and since they could never anticipate which one it would be, players must prepare for every eventuality, must always exert themselves to the fullest. On the first day he ordered two players to run around the field twice, the awful drudgery known as laps. When they ran with disinterested lethargy, he said with a snarl: “If you fellows don't want to give me 100 percent, get on up to the clubhouse and turn in your equipment.” Players soon realized they were better off putting out every ounce of energy during the drills than running laps during or after practice. When a receiver dropped an easy pass in the morning, Vince quickly ordered the penalty: “Take a lap.” Observed a player, “There wasn't a dropped pass the rest of the morning.”11

As a business owner, you are responsible for coaching the fundamentals in your business. One of the most important fundamentals is to know that the business instruments your accounting and administrative staff prepare are correct.

It is highly probable that you are being given bad information about your company. So remember, bad decisions based upon bad information can cause a company to crash, just as bad instruments or bad instrument reading can cause a plane to crash.

Getting past the many business illusions you face will require you, the owner, to get correct financial and operational information about your company. While you may delegate details to others, you cannot delegate the responsibility of making sure these business instruments are correct.

The risk of defaulting on this key responsibility is very high. It may cause your business to crash.

PEACE OF MIND

Your company can hire our professionals on a Form 1099 basis, which can improve your peace of mind.

Our professionals consist of long-term business advisors who can work for your company for as many years necessary to achieve your goals. The ability to avoid turnover will help with your peace of mind.

Our national resources can be confidentially brought to you and will give you peace of mind knowing you have hired a firm that can provide the professionals needed to grow your company.

Our business advisors each average more than 20 years of experience and can provide consultation and advice during the complex process of growing a successful business.

INCREASE PERSONAL WEALTH

Profit and cash improvement are paramount in our process. Ideally, the cash eventually should be transferred to the owner(s) of the privately-held company to increase personal wealth.

We work with independent CPAs and attorneys in a team effort to maximize the ways to increase personal wealth of business owners.

We can assist with cash flow and financial projections to help you make decisions about your future in an effort to increase personal wealth.

We work with wealth managers in a team environment to determine the best ways to increase your personal wealth.

We have the talent, tools and processes to help sell your company

SECURITY FOR LOVED ONES

We work with attorneys and wealth managers to determine the methods you need to improve security for your loved ones.

Attorneys and wealth managers usually need timely financial information to provide the advice you need about building security for your loved ones.

Our focus on gross profit optimization and streamlining processes help increase company assets and builds security for your loved ones.

We give timely consultation and advice to help build security for your loved ones.

MORE FREE TIME

Our book, Avoiding The Danger Zone, Business Illusions (Chapter three), explains that as sales increase, many business owners gradually take on tasks that over time weigh them down and stops them from finding opportunities to grow their business. We have the experience to help you through this phenomenon.

Our goal is to take these Minding activities off your agenda. Freeing you up to look forward and to complete your Entrepreneurial duties.

We can take over some of these high level, strategic tasks and in turn train your internal staff to complete the others.

Chapter 3: Distractions

Excerpt from Avoiding The Danger Zone: Business Illusions

Copyright © 2007 by Jerry L. Mills and B2B CFO, LLC.

Gordon Segal is the founder and CEO of Crate and Barrel, which he and his wife founded in 1962. The Retail Marketing Association voted Mr. Segal Retailer of the Year in 1996. Mr. Segal made one of the most profound business statements I have ever read, which was documented in INC. Magazine:

Getting distracted is the biggest problem entrepreneurs face.12

The authors of The Millionaire Next Door said the same thing in different words:

Efficiency is one of the most important components of wealth accumulation. Simply: People who become wealthy allocate their time, energy and money in ways consistent with enhancing their net worth.13

The above information is critical for your future success and needs to be thoroughly understood. Let's first look at the big picture regarding your needs as we explore this important topic.

In terms of weight, an ounce is not very heavy. One ounce is roughly the weight of a standard envelope with one page enclosed. Gaining an ounce of weight in a day would not be worrisome for the average adult male or female. But gaining an ounce of weight every day for two years is another story, resulting in a weight gain of 46 pounds for the average adult!

The above illustration also describes what happens to business owners when sales increase. Each day, a few ounces of weight are added to the owner's time until the weight on that time is so heavy that the owner is pulled into doing things that are counterproductive and often destructive to the success of the company. In short, over time, the owner will not be able to do what he or she wants in his or her own business!

Many business owners are frustrated to find that the people and professionals who surround them do not understand what they, the owners want. It has been my observation that almost all business owners want four things from their business:

To achieve any and all of those goals the owner must make optimal use of time. That is why Gordon Segal stated that the biggest problem entrepreneurs have is getting distracted. It is also why the authors of The Millionaire Next Door talk about the importance of allocating time and effort wisely in becoming wealthy.

The mastery of your own time will determine whether you will be able to obtain the four goals above. I am going to go into some detail to explain the B2B CFO® way – the cause-and-effect of your time in your own business.

I go into a lot more detail on this subject in my book The Danger Zone: Lost in the Growth Transition, and recommend that you read that book to get more background.

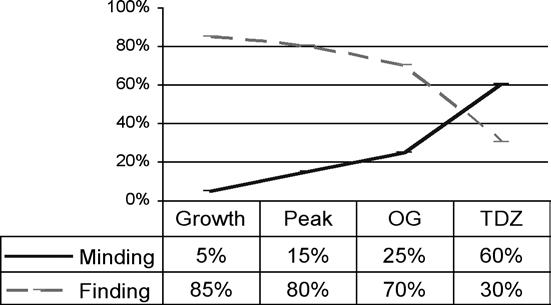

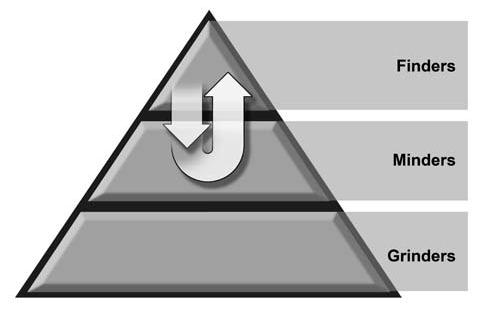

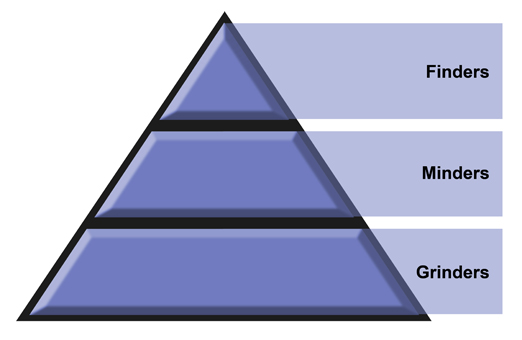

The following graph illustrates how your company is organized today. This organization is present, whether you are consciously or subconsciously aware of it. This organization exists whether or not you want it to exist. It exists regardless of the industry in which you work. Your future success is dependent upon whether or not you are able to properly function within this organization.

Let me briefly explain the meaning of the above three levels of your business.

Finder

The entrepreneur, the visionary, the leader, the idea generator and the catalyst for future change. Finders work in the future.

Minder

The administrative, accounting and operational staff of the company. Minders are historians and paper pushers. Minders work in the past.

Grinder

The people who do the physical work of the company. Grinders may be construction workers out in the field or telemarketers at a desk. Grinders work for today and are not concerned about the future or the past.

The most important function in this organization is that of the Finder. The company cannot continue without a visionary or a catalyst for future change. The other roles are also needed for a company to survive. The Minders and Grinders, however, can be replaced by others and are not individually indispensable.

Finders open the business relationships and ideas that allow sales to flow into a company. We can tell the value of a Finder by viewing the increase in sales of a company. Increased sales are the result of a Finder's leadership, vision, ideas and future direction.

As sales increase, we see a quiet type of business cancer grow within the business – the cancer of incrementalism. I call this Minding Cancer.

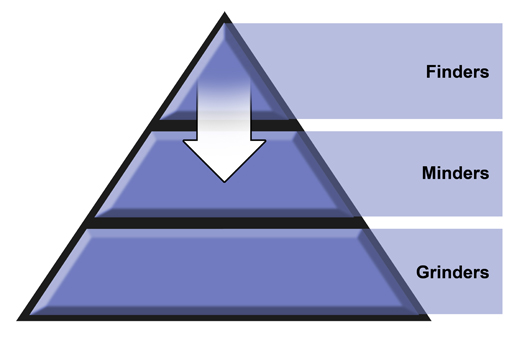

Step-by-step, we see a business owner being dragged from Finding activities into administrative activities, which we call Minding activities. The Finder then changes roles, as is illustrated by the next graph.

So, incrementally, the Finder starts spending most of his or her time in administrative duties. What do they do in administration? I could write an entire book on this subject. The following should give you an idea about these administrative duties:

I have often asked Finders, “Did you go into business so you could do accounting and administration?” Not surprisingly, they always respond with a resounding, “No!” When I ask them why they do such administrative tasks and duties, I get varied responses – and the responses never address the real issue.

Decreased sales are usually the result of a business owner inflicted with Minding Cancer. A significant decrease in sales will start to cause cash problems. Cash problems will compound and may lead to the death of the company. It is simple cause-and-effect.

Let me put things in perspective: The more time Finders spend in Minding activities, the more power they are giving to the competition. Competitors will be smiling with glee at the Finder's self-imposed plight and will take the first opportunity to kill the Finder's company. They will be like jackals licking their chops over the corpse of the Finder's former company.

People are often confused and curious about why Finders allow themselves to get Minding Cancer. They often ask me, “Why in the world would a Finder ever want to spend his or her time doing administrative tasks to the detriment of the company?”

The answer to this question is quite easy to answer. We can go back to Chapter Two of this book, to the example of pilot crashes, to see an almost exact parallel.

Some pilot crashes occur because the will to survive takes over at the moment of crisis and causes the pilot to react to his gut-feel about what should be done at that very moment. Instruments, opinions of co-pilots and other information become irrelevant at the moment of crisis because the basic desire to live causes the pilot to do what his instincts tell him to do, even if his instincts are wrong.

And so it is with Finders who become infected with Minding Cancer. They typically jump into Minding activities when there are problems with cash, accounting, payroll and other such matters. The Finder used to easily fix these problems when the company was much smaller. The company is much larger now, and there are too many people, transactions, customers, vendors and activities that seem to be moving at the speed of light, almost like a pilot viewing his plane speeding uncontrollably towards the earth. The problems are very hard to fix and often seem impossible to resolve.

The owner then begins to make decisions based upon gut-feel, just like a pilot who is about to crash. The owner often ignores opinions of others and the business instruments given to him (balance sheets, profit & loss statements, etc.) and makes decisions based upon gut instincts. The opinions of others, business instruments and other tools become irrelevant to the owner at the moment of crisis because the basic desire to keep the company alive causes the owner to do what his instincts tell him, even if his instincts are wrong.

All too often, gut instincts are distorted due to the complexities of the moment, and the company crashes. It either goes out of business or files bankruptcy.

I mentioned above that one of the four things owners want is personal time away from the business. They want a company that can run without them, like a well-oiled machine. They want to be able to travel, spend time with the family and do other fun activities with no concern about the company's success.

A Finder with Minding Cancer can forget about spending personal time away from the business. Things are too complex to get away from the office. In fact, time at the office begins to increase instead of decrease. I have had owners tell me, “I have not had a vacation in three years,” or “I missed my daughter's high school graduation because of my business.” These Finders often feel trapped and boxed into a corner.

Minding Cancer follows them 24/7/365. Any “vacation” or other time spent away is mixed with minding the business. The owner goes online and looks at cash each day, calls/emails the staff regarding checks to cut, spends significant time answering emails, and so forth. Time at a child's ball game or other event is spent on the cell phone running the business. The Finder's voice is raised, blood pressure goes up and everyone around feels uncomfortable. The children of the Finder, hungry for attention, notice what the Finder is doing and often feel disappointment, anger or rejection as a result.

The damaging effects of Minding Cancer extend beyond the business. Divorce, damaged relationships with children, diminished time with friends, damage to personal health, decreased mental health and diminished spiritual health are some of the results of Minding Cancer.

This disease must be eradicated unless you are willing to live with the consequences of this self-imposed disease.

There are three steps to curing Minding Cancer. The Finder must:

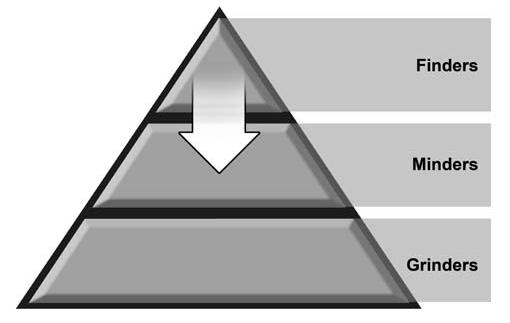

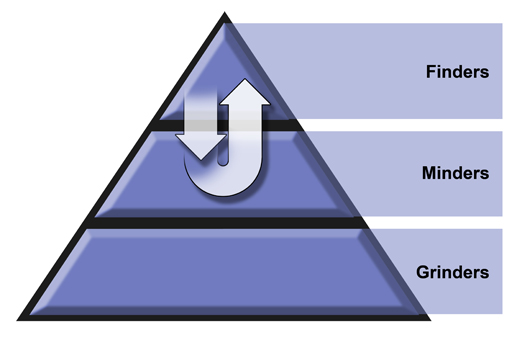

The result of getting rid of this Minding Cancer looks like the following graph.

Now the Finder can get back to the role of being the visionary, the leader, the idea generator and the catalyst for future change. Sales should then increase, and the company's organization should begin to be better balanced. This time, the competition narrowly missed an opportunity to move in for the kill. They will continue to hunt the Finder's company. But a wise Finder will create a vision to keep ahead of the competition. A really good Finder will be able to turn the tables and purchase or quash key competitors. Survival goes to the fittest Finder.

Finders should not allow themselves to become distracted. Distraction is an illusion. Rather than simply keeping busy, Finders should be engaged in activities that are truly productive. Ideally, Finders should spend about 80% of their time in Finding activities and delegate the Minding and Grinding to others. Finders should teach the fundamentals as Vince Lombardi did, make sure the fundamentals are being done and then invest the rest of their time in productive areas. The survival of their companies depend upon it.

SOLID RETIREMENT PLAN

We work with attorneys and your third-party administrators (TPA) to determine the best plan for your retirement, which may include a Defined Contribution Plan, a Defined Benefit Plan or a combination of both.

Your wealth manager will enjoy the timely financial information we provide. So our professionals can assist with the planning of your solid retirement plan.

We also provide advice and consultation regarding alternative possibilities of building a solid retirement plan, such as the investment in real estate and/or other cash producing assets.

We help improve your company's profit and cash flow to help you build a solid retirement plan.

REDUCED STRESS

Our ability to assist with key functions at your company will help reduce your stress level because you finally will experience professionals who can handle key responsibilities.

Timely financial and managerial information will help you make key decisions and help reduce stress so you are not in the dark about your company's information.

Our professionals can help supervise certain accounting and managerial functions to help you reduce stress.

Our focus on increased profit and cash helps reduce your stress levels.

Chapter 16: The Black Clouds that Haunt

Excerpt from The Danger Zone: Lost in the Growth Transition

Copyright © 2006 by Jerry L. Mills and B2B CFO, LLC.

It has been my experience that most Finders live 24/7, 365 with things that bother them about their business or businesses. The purpose of this chapter is to identify some of those concerns and to propose possible solutions.

Black Cloud #1 - April 15th

I was in Scottsdale last year having a meeting with a Finder who was a referral from a bank. We were enjoying a pleasant conversation discussing both of our companies. He was in an unique industry and was experiencing significant growth in his company.

During the conversation I asked a simple question, “Do you receive accurate internal projections about the amount of money you will owe the IRS on April 15th?”

His demeanor instantly changed. He became very agitated and said, “Jerry, let me ask you a question. Why did my CPA make me write a check to the IRS for $138,000 last week when my company doesn't even make any money?”

It has been my experience that Finders walk around 24/7, 365 with a black cloud related to the subject of income taxes. They either have had bad experiences, such as the one mentioned above or have heard about the bad experiences from colleagues. They know their company is growing and are expecting something bad when April 15th hits.

It has also been my experience to know there is no reason for a Finder to walk around with this April 15th black cloud. Income taxes are, after all, just math calculations. Mathematical calculations can be computed at any time, assuming the information being used is accurate.

B2B truism:

Many Finders spend too much energy worrying about the amount of money they will owe the IRS on April 15th.

A Solution to April 15th

There is a solution to the April 15th problem. I'd like to suggest four steps for you to follow to resolve this issue. You will sleep better at night and can get rid of this black cloud if you delegate and make sure that competent people do the following:

Accurate Financial Statements

Moore's Law, discussed in Chapter 13, has significantly impacted this topic of accurate financial statements.

On the positive side, it has created opportunities for Finders to have very good computers and accounting software for a minimal cost. When I first started my career, a business owner might need to invest a six-figure amount in computer infrastructure for accounting hardware and software. Today, a Finder can purchase hardware and software to help run the business at a fraction of the cost that was required a few decades ago.

The bad news is that much of the accounting software that can be purchased today does not require skilled people to input financial information, such as cash disbursements, cash receipts, bills from vendors, etc.

A Finder's natural tendency is to invest as little cash as possible in this area. Consequently, we see people who input data into the Finder's computer with no idea if the information is correct or incorrect. We then see the classic effect of GIGO – garbage in, garbage out. Often we see accounting staff who have absolutely no clue as to whether or not the financial information is right or wrong. Sometimes we discover that accounting staff have over-stated their abilities when they interviewed for the job. Sometimes we determine that the accounting staff had the basic skills when the company first started but do not have the knowledge when the company is several times larger than when it was in its infancy.

We also see the complication of related-party transactions. Finders have a tendency to create multiple companies. The internal accounting staff typically can input data, but has no idea as to whether the data as it relates to the various entities is right or wrong.

B2B truism:

Your company must have accurate financial statements in order to make accurate projections of the income taxes that will be owed on April 15th.

It is our recommendation that the Finder's financial statements be accurate each and every month of the year. It is the Finder's responsibility to hire the right people to ensure financial statement accuracy.

B2B truism:

Employees are often afraid to admit mistakes or to notify the Finder about bad news regarding the financial statements. These employees are concerned about their “job security” and will often not disclose bad news until it is absolutely imperative, even if the failure to disclose errors is to the detriment of the Finder.

Timely Financial Statements

Your financial statements need to be issued monthly. Unless there is an unusual circumstance, the financial statements should be issued no later than the end of the next month.

Calculate Income Taxes Monthly

It is very simple to calculate income taxes monthly after you have timely and accurate financial statements.

Most closely held companies are pass-through entities for income tax reporting. That often means that income from one company can be offset with losses from another company, provided there is sufficient basis in the company that has incurred the loss. There are different rules for “basis” calculation for S-Corporations and LLCs, however the rules are simple to understand.

B2B truism:

Many Finders become very frustrated on April 15th because they discover, at the last moment, that the losses in one company can't be used to offset income in a different related-party company.

You should be told, each month, the approximate amount of income taxes that will be owed on April 15th. You should then be able to know the amount of cash that needs to be set aside to pay your income taxes.

B2B truism:

There should be no negative surprises to a Finder on April 15th.

Verification From Your Independent CPA

You should have your independent CPA verify the internally-projected income taxes at least once a quarter. This will give you some peace of mind regarding April 15th. This quarterly update should not cost much money if the internal financial statements are accurate and timely.

Black Cloud #2 – Decision Making

Finders, by personality trait, are quick decision makers. This is one of the attributes that sets them apart from others in our society. They quickly gather facts and use their intuition to make decisions. This is a good trait and is necessary for good leadership. This trait, however, can lead to disaster if the facts the Finder is using are erroneous.

Most Finders are of above-average in intelligence, regardless of their formal education. This being said, one must realize that it is highly probable that the Finder of one's competition is also above average in intelligence. In the long run, the goal is to make better decisions than the competition; otherwise, the Finder runs the risk of being beaten by the competitor. The question then becomes, “How does a Finder make better decisions than the competition?”

Regardless of your intelligence, you increase the probability of making a bad decision if the information you are using to make the decision is erroneous.

B2B truism:

Bad financial information typically leads to bad decision making.

Conversely, you increase your probability of making good decisions if the information you are using to make the decision is correct. One of the reasons a Finder must invest in infrastructure is to be able to receive accurate and timely information from the accounting department. The risk is too great to cut corners on this important function.

B2B truism:

If you expect to beat your competition, you must have better financial information infrastructure than does your competition.

Black Cloud #3 – Borrowing From the IRS

One of the joys I have experienced in life is waking up early in the morning at Lake Powell to witness the beauty of the lake before any boats or humans hit the surface. The view is stunning. The lake reflects the shapes and colors of the surrounding canyons like a piece of glass. After pondering the beauty of the surroundings, I typically pick up a stone and toss it into the lake. If I toss the stone out 20 feet or so, I can watch the ripple effect of my actions. Eventually, the impact of the stone will cause hundreds of rings to form around the point of impact. It is an interesting sight and gives me an opportunity to ponder upon life.

The above is analogous to another effect of Moore's Law, which was discussed in Chapter 13. The ripple effect of this law has caused an infusion of cheap accounting software into the business community. While often appearing advantageous, the improper usage of this software can turn into a disaster for the Finder.

We see too many companies that have their Minders cutting payroll checks from software packages owned by the Finder's business. This creates great potential for problems to arise in the following areas:

All too often, the Minder does not do things correctly in these areas and the Finder is then responsible to the IRS and state governments for the errors caused by the Minder.

Another danger exists in this area as a company gets closer to The Danger Zone. Often, as a result of cash shortages, the Finder will make a decision to not pay the payroll taxes to the IRS. The initial idea by the Finder is to use this cash, on a temporary basis, to cover other cash flow problems. This often turns into a situation that is not easily reversed.

B2B truism:

Never borrow money from the IRS or any other governmental taxing authority.

The Federal and State withholdings from your employees pay are typically called “Trust Funds.” The government does not look favorably upon business owners who delay payments on trust funds. The penalties in terms of dollars can be significant. I have seen penalties ranging from 25% to 35%. Even worse, the government can charge the business owner with civil and criminal penalties. The cost is not worth the perceived benefit. Avoid borrowing from the government, at all costs.

The payroll processing wheel has been invented. There are multi-billion dollar companies that can process your payroll on a cost-effective basis. They can also provide your company with current human resource manuals that can help guide you though the complicated issues related to human resources.

B2B truism: Concentrate on your company's core competencies and avoid re-inventing the payroll and human resources wheels.

Pitfalls of Internal Payroll Processing

Some of the pitfalls of payroll processing and human resource management include:

RECORDKEEPING

The Fair Labor Standards Act requires employers to keep the following records:

“Every employer covered by the Fair Labor Standards Act (FLSA) must keep certain records for each covered, nonexempt worker. There is no required form for the records, but the records must include accurate information about the employee and data about the hours worked and the wages earned. The following is a listing of the basic records that an employer must maintain:

Payroll recordkeeping is too complicated to try to cut corners or to handle internally. Eventually, the internal accounting or human resource department will make an error. The error could be significant and is not worth the risk. The hiring of a payroll processing company does not mean a Finder needs to lose control of payroll. If you wish, you can still sign checks. You do not need to have the entire payroll (net checks) taken out of your account in one lump sum.

B2B truism:

Use a payroll company to build your payroll and human resource infrastructure.

Black Cloud #4 – Overtime

There are few companies that do not make errors in overtime calculations. The penalties for making errors in overtime can be severe and can cause much damage to a company.

Overtime is governed by the Fair Labor Standards Act (FLSA) and was approved by Congress in 1938. It is stunning to me that a law created so long ago is so little known or understood by Finders today.

It is not unusual for me to be hired by a company and to discover that the company is in violation of the FLSA. The violation is often in the form of paying a person a “salary.” When bringing the issue up to a Finder, the response is typically that the person does not get paid overtime because they are on a salary. Finders often become frustrated when I explain that there are rules that require payment of overtime, even if a person is being paid a salary.

B2B truism:

A company may be responsible for overtime, even if an employee is being paid a salary.

There are certain exemptions for executive, administrative, professional, outside sales and computer employees, however; the reasons for those exemptions must be known and documented.

There are also rules that require overtime with a commissioned sales staff. The rules are somewhat complicated but are not worth the risk of violating.

The FLSA has made the following statement:

“An employer who requires or permits an employee to work overtime is generally required to pay the employee premium pay for such overtime work. Employees covered by the Fair Labor Standards Act (FLSA) must receive overtime pay for hours worked in excess of 40 in a workweek of at least one and one-half times their regular rates of pay.”25

I have participated with numerous Department of Labor (DOL) audits during my career. Typically, I have been brought into the argument after the overtime laws have been allegedly violated. I have discovered that the DOL laws, while complicated, are documented very well.

I have observed through numerous meetings with the DOL that they try to be fair but are not flexible.

I remember a wrap-up meeting with the DOL on a particular engagement. They thoroughly explained the fines and penalties. They also explained the time-frame for which the monies had to be paid. They surprised the business owner with a large fine that was in addition to the other monies that were assessed. The business owner got very upset and pleaded his case, but did not change the mind of the DOL auditor. After the business owner left the room I asked the auditor why the DOL was issuing the fine. I will never forget the answer, which was, “Jerry, this law has been in place since 1938 and the owner should have taken the responsibility to know the law.”

B2B truism:

The Department of Labor is powerful. Their laws, some of which were enacted in 1938, should be understood and complied with by the business owner.

Black Cloud #5 – Control

Few things bother a Finder more than feeling a loss of control over the company. Finders who own growth companies sometimes feel as if they are steering a large ship without a rudder.

The feeling of loss of control typically results from failure to build a proper infrastructure. Some of the infrastructure areas that cause the most frustrations are:

Here's my advice. Never relinquish control of important infrastructure areas. This does not mean you should be a micro-manager of these areas. It does mean that you should hire the best people available so that you can trust what they are doing for your company. Regarding accounting and accounting records, I have some suggestions:

B2B truism:

A Finder should never relinquish control over the company.

Black Cloud #6 – Being Held Hostage

Invariably, when engaged with a company, I will sit down with the Finder and explain that certain employees have the ability to hold the company hostage. This means that certain employees have so much knowledge or so many responsibilities that, if they were to leave the company, the act of leaving would cause serious harm to the company. I have seen employees who, understanding this hostage-holding issue, have created situations where he or she has negotiated salary and benefits that exceed the market for their particular skills. This is hostage-taking by the employee of the Finder and the Finder is often afraid of reprimanding, terminating or disciplining the employee because of possible repercussions to the company.

The keys to correcting this situation are to

(1) identify the potential hostage-holding situation and (2) hire someone to create an infrastructure around the situation. In other words, internal controls and other systems need to be put in place so that the company can continue to function if the person was to leave the company, either voluntarily or involuntarily.B2B truism:

Hostage-holding by one of your employees, whether voluntary or involuntary, is detrimental to any company.

Black Cloud #7 – The Balance Sheet

I truly enjoy visiting with Finders. I become motivated by their intelligence, their drive and their ambitions.

One of the peculiar things about a Finder is that they can always tell me their personal net worth.

If we are talking over lunch about this subject, the Finder can grab a napkin and write his or her net worth on the napkin in a few minutes. They know the value of their homes, the mortgage and the other assets they own. They have a keen ability to keep numbers in their heads and know their major personal assets and liabilities.

On the other hand, for some reason, Finders react differently when I bring up the subject of the company's balance sheet. Finders typically tell me things such as, “I don't understand the balance sheet,” or “I see no reason to look at the balance sheet,” or “I know the balance sheet is wrong, so there is no reason for me to get involved,” or “The balance sheet is not important to me because it does not show the true value of my assets.”

There are numerous reasons why you need to understand your company's balance sheet. A few of the key reasons are:

B2B truism:

The Finder must understand the company's balance sheet.

Black Cloud #8 – Employee Pay

The proper amount to pay an employee is a frustrating topic to Finders. There often seems to be no middle ground on this topic.

Business owners often feel they are over-paying employees and search for rules or guidelines for pay. One can go on any search engine to find grades of recommended pay for employees. These published grades of pay are usually meaningless.

A simple rule of thumb can be used to determine the amount an employee should be paid: Find the amount of money it will take to replace and train the employee. Unless unusual circumstances occur, the company's employees should not be paid above market value.

B2B truism:

Employee pay is dictated by the market.

B2B truism:

An employee who is paid above market will eventually leave the company.

There are a few reasons that an employee who is being paid above market will eventually leave the company:

Pay your employees what the market will bear, and nothing more than that amount. There is nothing wrong with giving periodic bonuses to reward outstanding or exceptional behavior. Any bonus given to an employee should acknowledge that (1) the bonus is for a specific event or period of time and (2) any future bonuses will be discretionary and may or may not occur.

Black Cloud #9 – Statement of Cash Flows

The company's statement of cash flows is typically the financial statement document that the Finder least understands. This is an unfortunate situation because the statement of cash flows is often the most important document the Finder can use to run a company.

The premise behind the statement of cash flows is very simple: It begins with the year-to-date profit or loss and shows the specific areas where cash has increased or decreased.

While the premise of this document is simple, the practical application is very complicated. The form itself, as dictated by GAAP (Generally Accepted Accounting Principles) is inadequate.

That being said, the Finder must understand the statement of cash flows. There are ways, assuming you surround yourself with the right people, that you can understand this document.

Once you understand the statement, you can use it to run the company and be more in control of cash.

A simple way to determine if you need more help with this subject is to have your existing staff explain the statement of cash flows to you. You are in good shape if you sense confidence from the staff and if you can understand the document with the staff's explanation. The opposite response should give you cause to consider bringing in someone else to help with the matter.

B2B truism:

A Finder can't run the risk of not understanding the Statement of Cash Flows.

Finders: There is no reason to have any of the black clouds described in this chapter follow or haunt you. Get rid of them and enjoy life a little more.

GROW SUCCESSFULLY™

Free Discovery Analysis

B2B CFO® will benchmark your company against others in the same industry and then using this information, show you how to Grow Successfully™. This is a must have for any business owner. Get your free Discovery Analysis today (a $1600 value)!